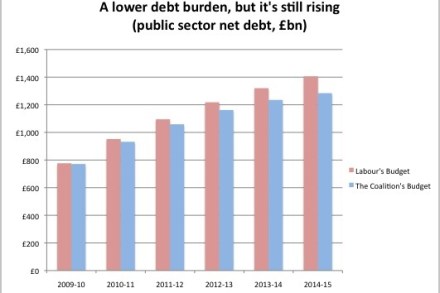

Our rising debt burden

Debt may start falling as a share of GDP at the end of this Parliament (see p.2 here), but it’s still going up in cash terms. Here’s a comparison with Labour’s last Budget:

Debt may start falling as a share of GDP at the end of this Parliament (see p.2 here), but it’s still going up in cash terms. Here’s a comparison with Labour’s last Budget:

Well, that was excitingly unexciting. There was little in George Osborne’s Budget that we didn’t expect, either in terms of rhetoric or policy. But it still felt new and different nonetheless. Here we had a Chancellor setting out exactly how much spending he will cut, and putting plenty of emphasis on both our deficit and debt burdens. It drew a stark contrast with the Brown years, and was a solidly understated performance in itself. There will be plenty of attention paid to the hike in VAT, and rightly so. But there were some macroeconomic forecasts which were just as eyecatching. In his address, Osborne suggested that the deficit on “current

1343, PH: Harman has sat down now, so we’ll draw the live blog to a close. I’ll write a summary post shortly. 1342, FN: I wish I could trash Harman’s response, but it’s actually quite good. Many a Tory would be secretly cheering her trashing of the LibDems. “The LibDems denounced early cuts, now they’re backing them – how could they support everything they fought against, how could they let down everyone who voted for them?” Again, a fair point. “The LibDems used to stand up for people’s jobs, now they only stand up for their own.” Her main point – that forecasts for unemployment have risen – is a

In 2009, Britain borrowed more, as a share of its national income, than any country that isn’t being bailed out by the IMF and the Eurozone (Greece) or already making drastic spending cuts (Ireland). That huge deficit is the critical challenge to our economic stability that George Osborne needs to tackle with the Budget today. We have got away with high borrowing so far on the understanding that cuts are coming now the election is out of the way. If you think tax hikes are the answer, then you’re asking the wrong question. Our present fiscal crisis is built on a decade of bumper rises in spending, not tax

During the Brown years it was “stability,” but it looks as though the watchword for Chancellor Osborne’s first Budget will be “progressive”. This is the word that’s being bandied about behind-the-scenes, and the coalition seems confident that it has the policies to match the rhetoric. As the Guardian reports today, it’s likely that the personal income tax allowance will be raised by £1,000 or so, to help shield the least well-off from tax rises elsewhere. And the paper quotes a Tory aide saying that the richest will pay more, “both in absolute terms and as a percentage of their income.” Whether he drops the p-word or not, the arguments behind

There are plenty of details for Budget-spotters to look out for tomorrow, but among the most important is just how far Osborne reaches into the future. The current expectation in Westminster is that he will offer quite a few glimpses into the long-term. A possible commitment to reduce the main rate of corporation tax to 20 percent over the next five years, perhaps. Or similar provisions for making the first £10,000 of income tax-free. There are, of course, economic and political motives behind this. Economically, the plan will be to reassure the markets that the coalition has a deliberate plan which extends beyond the next few months (which was a

Today’s papers are awash with stories that a public sector pensions levy will be announced in tomorrow Emergency Budget. Trade unions have already issued dire warnings, ranging from the PCS’s promise to “organise the widest possible popular opposition,” to Bob Crow of the RMT’s rather prosaic: “when someone’s winding up to give you a kicking you have a clear choice — you can either take them on right from the off or you can roll over and hope that they go away.” Public sector workers, however, should not be so dismissive. In our report, released on Friday, we argue for an “Irish style” graduated public pensions levy of 7.5

There are two main aspects to the VAT issue: one distasteful, the other less so. The distasteful one is the issue of whether the government has a mandate for hiking VAT in tomorrow’s Budget. Of course, government is often the art of the unexpected, so we shouldn’t be surprised to see measures implemented that weren’t explicitly raised in the election campaign – particularly when it comes to tax rises. But all the claims that there were “no plans” to raise VAT do jar against reports like: “Osborne insisted the budget measures would be spread fairly across society, suggesting capital gains tax will rise and promising a new banking levy. But

One of the leitmotifs of this Parliament – and something which, by many inside accounts, is helping the coalition immensely – is the willingness of the civil service to wield the axe within their own departments. And now, courtesy of Reform and the Institute of Chartered Accountants, a new survey suggests that this mentality may stretch beyond Whitehall. It quizzes public sector “finance decision makers,” and the headline finding is that: “82 per cent of respondents think further savings can be made within their organisation in the next year without affecting the current level of service they provide.” Far more intriguing, though, is the finding that 84 percent of them

With the cuts comes the candy: the sweet-tasting morsels which, it is hoped, will prevent tomorrow’s Budget from being too much of a collective downer for the nation. We’re already hearing that a council tax freeze will be pencilled in for next year, and you can expect a few more treats besides. National insurance, for instance, is looking like an obvious candidate. From George Osborne’s perspective, these sunnier measures will serve a two-fold purpose. Like I say, it will be hoped that they keep the public on board with the government’s project: stick with us, the message will run, and you’ll get more of this in future. But they will

It’s days like this when you realise just how stuck Labour are in a Brownite groove. Everywhere you turn, there’s some leadership candidate or other attacking the government for choosing to cut public spending this year. Ed Miliband claims that the Lib Dems have been “completely macho … completely cavalier” about cuts. Andy Burnham says that this year could “damage us in the long run”. And even those who aren’t chasing the leadership are getting in on the act: Alistair Darling writes that the coalition has “a fiscal policy that undermines fragile growth”. So we already know what Labour’s broad response to this week’s Budget will look like. But it

I’m quite optimistic about George Osborne’s budget – in the same sense that one might have been optimistic when Churchill took over from Chamberlain. Not because the situation is good, or because you think the road ahead will be easy or enjoyable, but because the road no longer leads to disaster. Not that Osborne is a Churchill – even though he will have his own fair share of blood, sweat toil and tears for us on Tuesday. I’m pretty confident he’ll head in the right direction, and at the right speed. I discuss this in my News of the World column today, but will say a little more here: 1.

Alastair Campbell is right on two counts. First, that this snippet from George Parker’s Budget preview is pretty fascinating: “Senior Lib Dems whisper that Vince Cable, the Lib Dem business secretary, never really believed his pre-election rhetoric that cuts should be delayed until 2011.” And, second, that the claim about Cable is downright unbelievable. I mean, this is the man who attacked Tory spending plans at every opportunity he could, and more venomously than any of his colleagues. The man, indeed, who pushed the line that “the economy will be plunged back into prolonged recession” as a result of early cuts. And the man who, by many behind-the-scenes accounts, encouraged

It’s hard to overestimate the significance of Tuesday’s Budget. George Osborne’s statement won’t just determine the course of our economy for the next few years, but also the political life of this government. Spending cuts and tax rises may not inevitably “fracture the coalition,” as Peter Oborne puts it in the Mail today. But they certainly have the potential to. Happily for the coalition, the current political mood is so geared towards fiscal restraint that there will be little immediate opposition to Osborne’s general plans. That will come once the effects of spending cuts are felt in individual constituencies – months, even years, down the line. But there are a

After all the hoo-haa about Lord Ashcroft’s tax status, it’s only fair to mention this passage from his interview with the Telegraph today: “He explains that new laws brought in under the Coalition mean that all members of the Lords will have to be fully taxed. Yes, I reply, but when does he plan to come onshore? ‘I already am.’ Really? There has been no public announcement. So he is now paying all of his taxes, including everything that comes from his businesses around the world? ‘Yes. So I say to people don’t go moaning on about it because it is no longer an issue. The point is moot… Can

Tick, tock, tick, tock: only three-and-a-bit days to go until George Osborne’s long-anticipated austerity Budget, and the coalition is gearing up its efforts to prepare us for the worst. Exhibit A is David Cameron’s interview in the Times this morning, which contains few pleasantries and a whole heap of stern talk – particularly for those in the public sector. As the PM puts it: “There is no way of dealing with an 11 per cent budget deficit just by hitting either the rich of the welfare scrounger … there are three large items of spending that you can’t ignore and those are public sector pay, public sector pensions and benefits.”

I doubt David Cameron will have many better days in government than this. Considering the government cancelled a hospital project yesterday, today has passed as one long photo-op, free of incident. It began with Theresa May banning a radical Islamist cleric, Zakir Naik, displaying a resolve that eluded her immediate predecessors. The papers were full of Cameron’s ‘coup’ in Brussels yesterday; the only major news story that might have unnerved Cameron was the FT’s research into Tory immigration policy, which the FT calculates will hit growth and raise taxes. It was too esoteric to hit the TV screens, so too the cuts in arts funding. It must have been a

Thank God for Iain Martin, who has called Labour’s response to the Gove ‘Free schools’ idea what is: ‘moronic’. He writes: ‘Labour warned that the resulting experiment risks creating a “two-tier” education system. Good grief. And Britain doesn’t have a two-tier schools system now? Actually it’s more like 10 tiers. In this troubling context, claiming that Britain somehow has a splendid one-tier education system that must be preserved is moronic.’ If enacted and delivered, the Gove school reforms will transform education: either they will inaugurate extraordinary improvements, or they’ll be catastrophic. For my money, I don’t think Gove has done enough to explain how buildings will be paid for, how

Theresa May has called for ‘culture change’ in wider society to ease the equality and acceptance of lesbian, gay, bi-sexual and transgender minorities. Abstractions are the executive’s favoured metier these days. I’ve read and re-read May’s article in Pink News and nowhere does she define ‘culture change’. The end product of a culture change towards LGB&T groups might be envisaged, but how is it initiated? The government cannot answer that question, beyond suggesting that supporting pride marches is positive. True, but society is more than a pride march. It exists in the daily confusion caused by ill-defined laws, such as who B&B owners let into their homes/businesses. Or whether it

Well done David Miliband, for writing an article in the Guardian that is free of wonkery and abstractions. Miliband deserves applause for being the first Labour leadership contender to address public spending cuts with reasoned analysis, not ideological retorts. Also, he is right to urge George Osborne not to sell the public stakes in RBS and Lloyds at a bargain price. But his central thesis merits censure. He perverts recent history to fit an avowedly left-wing analysis of public spending. Miliband writes: ‘Let’s take the deficit argument head on. We need to remember what the Tories want the country to forget: it was falling tax receipts – not rising spending