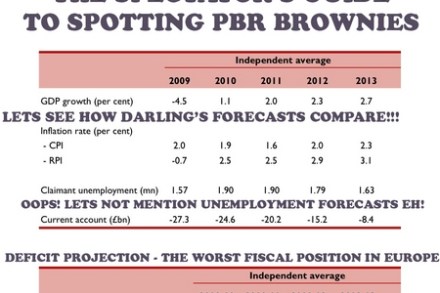

Those hidden cuts in full

The truth about the Pre-Budget Report was revealed today by the Institute for Fiscal Studies: the new National Insurance tax will hit everyone on £14k or over, not £20k – and there are implied 19 per cent cuts of some £40 billion in the “non-protected” areas. The event was sold out, because it now has the reputation as the only place you learn the truth about Budgets passed by this government. Yet again, Gemma Tetlow from the IFS has unearthed the cuts which the Chancellor felt he had to conceal from the public (and – unwittingly, I hope – lied about this morning on the radio). Coffee House showed you yesterday that the