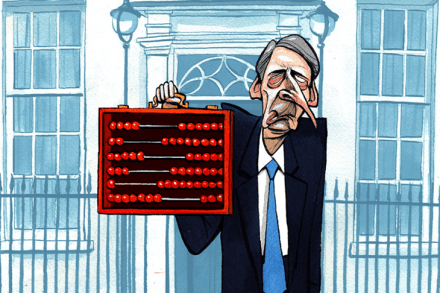

The self-employed power Britain. Tax them more at your peril, Philip Hammond

Claudio Ranieri will go down in footballing folklore as the individual who accomplished mission impossible by winning modest Leicester City the Premiership title in 2016. He will also be remembered by many footballing aficionados as Mr Tinkerman, the manager who had a propensity to tinker with teams (especially during his time at Chelsea) when a more laissez faire approach was called for. But like his job at Leicester, Mr Ranieri has now lost his Mr Tinkerman mantle. It has been wrestled from him by Philip Hammond, the meddling Chancellor of the Exchequer. For the time being, Mr Hammond wears the Tinkerman crown, albeit somewhat embarrassingly rather than vaingloriously. He adorns the