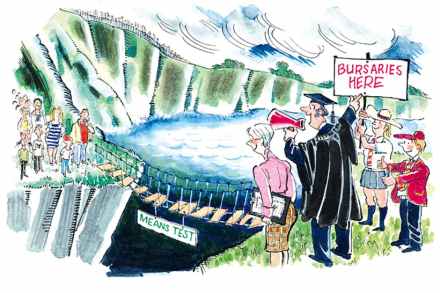

How can racing balance its funding structure with the issue of problem gambling?

This is an extract from Robin Oakley’s racing column in this week’s Spectator. You can tell by the tone of the jokes how most occupations are regarded and we’ve all heard the traditional ones about the old enemy. ‘Why don’t sharks attack bookies?’ ‘Professional courtesy’. ‘Why did God invent bookmakers?’ ‘To make used-car salesmen look good.’ ‘Why are bookmakers buried an extra six feet down?’ ‘Because deep down they are very nice people.’ OK, such stories are applied to lawyers too. And journalists. But as a Racing Post headline confirmed last week, bookmakers are under heavy pressure. William Hill has been fined £6.2 million for breaching regulations on social responsibility