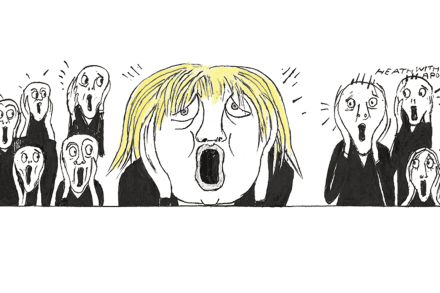

Does the ‘anti-growth coalition’ run the Treasury?

‘Permanent revolution’ is the on dit in Whitehall these days – and what it means is that the Truss administration U-turns so often the whole machinery of government is constantly spinning round on its axis. The latest volte-face is the decision to appoint James Bowler, a 20-year establishment veteran, as Permanent Secretary to the Treasury. The Chancellor, Kwasi Kwarteng, declared himself ‘delighted to welcome James back to the Treasury,’ which is causing a few chuckles in SW1. The joke in Westminster today is apparently that the anti-growth coalition actually runs the Treasury It’s well-known that Kwarteng’s plan was to shake up the Treasury. Bowler represents precisely the sort of orthodox