Who’ll be blamed for Rachel Reeves’s tax hikes?

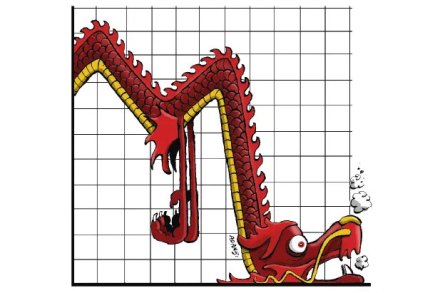

Rishi Sunak and Jeremy Hunt entered Downing Street with one mission: to clean up the public finances after Liz Truss’s mini-Budget debacle. They posed as the fiscally credible option. All bills would need to be covered, even if the tax burden had to rise. If the Tories were to lose power for being disciplined and truthful, then so be it. Reeves would like to pin any rise on the Conservatives: an extension of ‘Tory austerity’ rather than her own Rachel Reeves has sought to demolish their responsible reputation in her first weeks as Chancellor by announcing that she has discovered a £21.9 billion ‘black hole’ in the public finances this