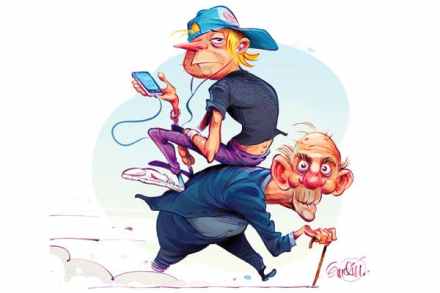

Is it really harder for young people to buy a home than it was 30 years ago?

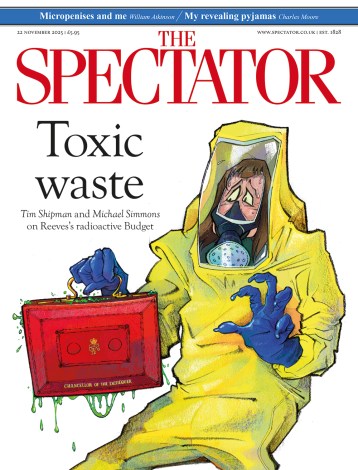

The Resolution Foundation has called for 25-year-olds to be paid £10,000 to help them afford homes, saying the ‘generational contract’ between young and old has broken down. But is it really harder for young people to buy a home now than it was 30 years ago? House prices were booming in the first half of 1988, when a typical first-time buyer home could cost £50,000. That same property now, according to the Halifax UK House Price Index, would cost £234,850. Since 1988, the Retail Prices Index has increased 2.7 times, according to the ONS, so, in real terms, £50,000 in 1988 is now worth £135,000 – making it harder to afford