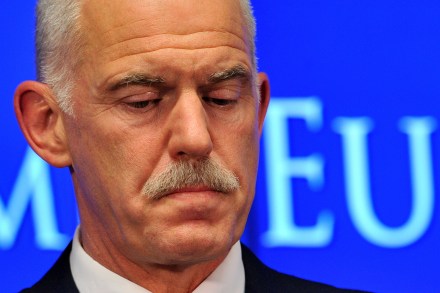

A Damoclean sword hovers above Papandreou

This is not Greek tragedy, it is a farce. Prime Minister George Papandreou’s idea to hold a referendum on the Greek deal has done the exact opposite of what he must have intended. Instead of giving him a new mandate, it seems it will take the existing one away from him. Several MPs and PASOK officials have called for his resignation or for the formation of a National Unity Government. Some have even resigned, reducing the government’s majority in parliament. European reaction has arranged from studied politesse to outrage. Ireland’s Europe minister has called the referendum idea a “grenade”. Privately, European politicians are seething. The Greek PM must know he