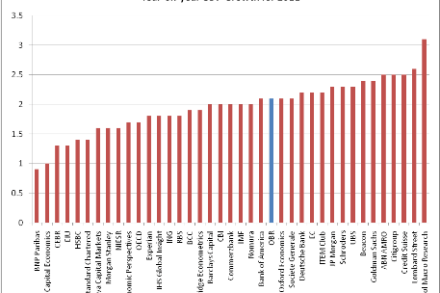

King’s inflation nation

If Mervyn King and his team are trying to deal with Britain’s debt crisis by letting inflation rip, I do wish they would just say so – rather than go through this monthly farce. Yet again, base rates have been left at an absurd 0.5 per cent, in an economy expected to grow by a full 2 percent this year but with inflation at 3.3 percent or 4.8 percent depending on how you measure it. Petrol prices are bad, but now they are matched with soaring prices elsewhere – from train travel to groceries. Here’s a list of some price rises confronting shoppers: Add Osborne’s VAT rise to non-food