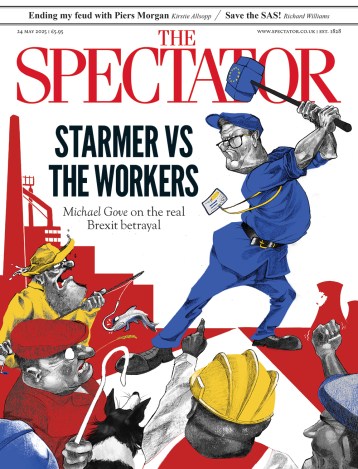

Another voice: Why the strike is right

If I were a teacher, I’d be on strike today. Public sector workers are being asked — in what is now a well-rehearsed soundbite — to work longer, receive less, and pay more. In these austere times, with deficit reduction a necessity, two of those three aims might be reasonable. But doing all three at once, and conflating the package with the spurious notion that public sector pensions are ‘unsustainable’, justifies the direct action being taken today. The rise in contribution rates — in effect a three per cent tax rise — will be especially hard to bear for those on modest salaries who are already facing a prolonged