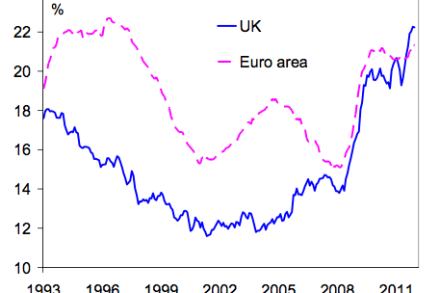

Why the immigration cap isn’t biting — and why that is good news

The government’s official advisers on immigration, the Migration Advisory Committee, have today published a report into the restrictions on skilled migrant workers from outside the EU. Turns out that the much-vaunted ‘cap’ on skilled workers has only been half taken up — with numbers likely to be around 10,000 against the cap of 20,700 — and that this is offset by the high numbers of workers, around 30,000, coming to the UK on ‘intra-company transfers’. (These transfers are designed for multinational companies wanting the flexibility to move their employees around the world: the example used by the Committee’s chairman today was of ‘Japanese auto-engineers testing cylinder-heads made in Japan’ for