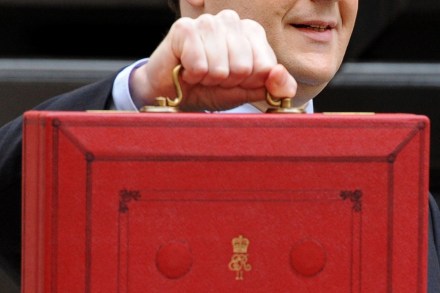

Twelve points about the Budget

There’s much to applaud in this budget, but as ever we in Coffee House are focusing on things jumping out from the small print. Here are a few things I’ve noticed so far. 1. Don’t mention QE. In his Pre-Budget Report, Osborne was candid about his economic policy: ‘fiscal conservatism, but monetary activism’. That is to say, fiddling about on the margins with taxes, while the Bank of England — 100 per cent owned by the Treasury — is midway through the largest QE experiment ever attempted in the developed world. It is impossible to understand Osborne’s economic policy, his Budget and those it affects without also considering the effects