Brexit isn’t to blame for dismal GDP growth – and nor is the weather

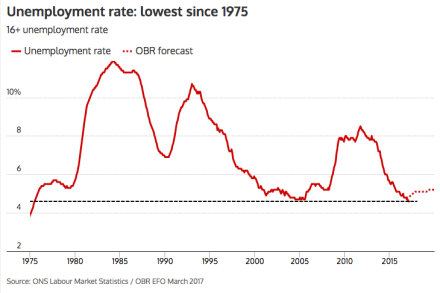

The government’s opponents were not slow, as usual, to blame today’s disappointing data on economic growth on Brexit (the IOD) or ‘austerity’ (John McDonnell) – while the Chancellor, Philip Hammond, chose to fall back on that old chestnut used by corporate spokesmen when announcing dismal results: the weather. None of these will really do as an explanation as to why GDP growth, according to the ONS, plunged from a healthy 0.4 per cent in the final quarter of last year to a miserable 0.1 per cent in the first quarter of 2018. As for Brexit, GDP figures have been shrugging it off for nearly two years – the economy even