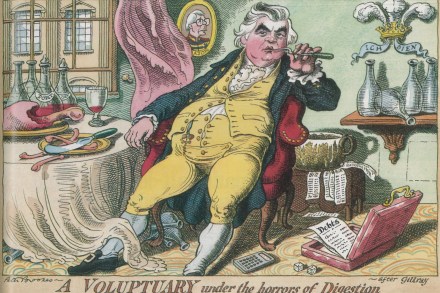

Economists – the scourge of mankind

Are there any disciplines on earth as hyped-up and overrated as economics? Every subject depends to some extent on others; you can’t, for example, understand history without a bit of geography or human biology, and you can’t master either of those without a bit of chemistry, for different reasons. The same goes for all disciplines – except, for some reason, economics, where the opinion of the experts seems to count for a great deal in discussions where their field is only one aspect. The great example of this was the euro, which was promoted by the great and the good of the dismal science as a brilliant idea because, of