Quantatitive Easing is an affront to democracy

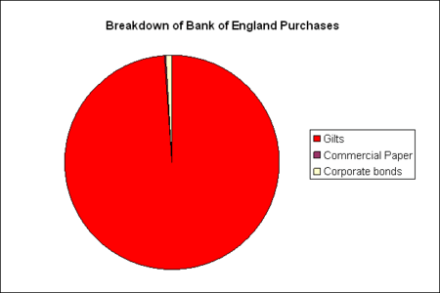

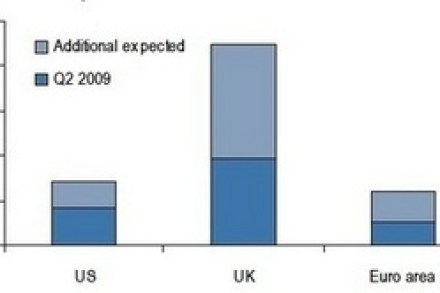

Readers of the Spectator will know George Trefgarne’s work, and today he delivered an important report on the dangers of Quantitative Easing. I urge Coffee Housers to read the speech. It provides an interesting and relevant insight into historical precedents for the policy and how to manage it, and gives a balanced analysis of the current policy’s pros and cons. Trefgarne concurs with Mark Bathgate’s critique. There is little evidence that QE has stimulated money supply, as banks are using the cash to re-balance their lop-sided books. QE is funding the government’s debt habit. The IMF estimates that QE has reduced the benchmark 10-year interest rate on government debt by