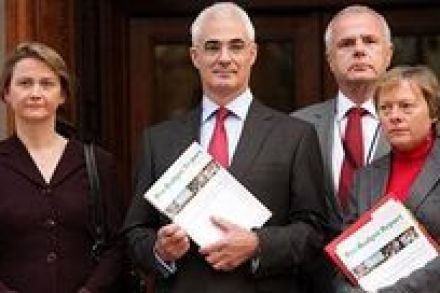

Three steps to cleaning up our toxic banks

Fraser outlined the problem with the British banks in his earlier post, but I’d like to suggest a three-step solution. 1. To deal with the problem, you have to admit to the problem. This is the First Step for Alcoholics Anonymous 12 step plan but holds true for politics. Say it out loud: the banking system is still broken. It needs fixed, and the process won’t be pretty. There will always be a political temptation to turn a blind eye, as there was in Japan during its ‘lost decade’. 2. Use an objective and credible third party to analyse the ability of banks to withstand losses, and to go