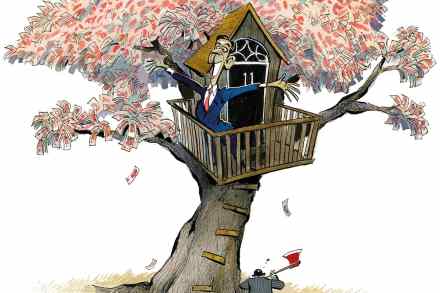

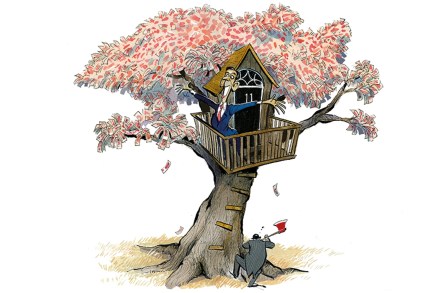

Has the Bank of England given up on its duty?

Has the Bank of England’s Monetary Policy Committee quietly excused itself from its duty of keeping inflation down: namely, keeping the Consumer Prices Index (CPI) close to a 2 per cent target? I ask because the minutes of its September meeting, released today, show little inclination to raise rates from their historic low of 0.1 percent, even though it predicts that inflation will rise above 4 per cent and stay there at least into the second quarter of 2022. The MPC seems to have evolved into a Committee for Leaving Interest Rates Alone or Occasionally Lowering Them You can argue that inflation isn’t everything, that growth matters more and that monetary policy should