Andrew Sentance: interest rates must rise

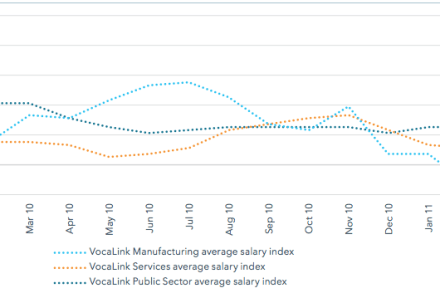

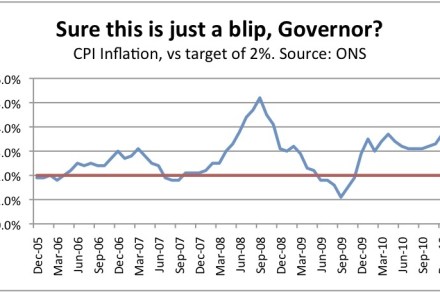

Inflation – the cost of living – is the number one issue in Britain today. It is under-discussed in the House of Commons as MPs have no say in it: the task of controlling inflation lies with Mervyn King and his nine-strong Monetary Policy Committee, and its members are rarely interviewed. Little wonder, as a lot of them should be feeling fairly sheepish. But not Andrew Sentance. He’s been arguing for a rate rise for months, and doesn’t have long left to serve on the MPC, so he can speak quite freely. Inflation has been above target almost all the time he’s been on the MPC, he says, so in