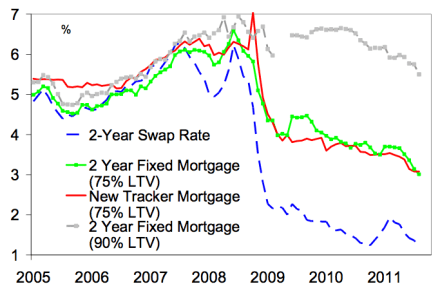

Project Merlin may not wield a magic wand

Are Project Merlin’s lending targets just a myth? On the basis of today’s figures it’s still rather hard to tell. The arrangement between the government and the banks did yield £214.9 billion of gross lending to businesses in 2011 — against a target of £190 billion, and a 20 per cent increase on 2010. But net lending also declined in every quarter of the year. And the target for lending to small businesses of £76 billion was missed by £1.1 billion. The banks have put this shortfall down to fewer small businesses coming forward for credit — and there’s actually some truth in that. This survey suggests that small businesses