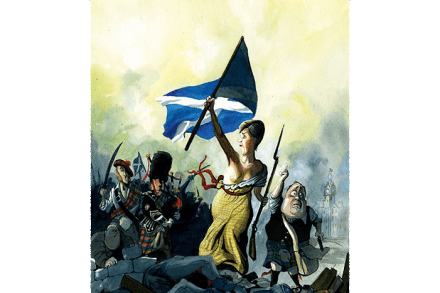

The SNP-Green alliance is a victory for the cranks

The SNP’s nationalist outriders, the Scottish Green party, are reported to be within touching distance of agreeing the terms of a formal cooperation agreement that will see them enter government for the first time. What will this mean for Scotland and its governing party? On the face of it, not a great deal. Some Green MSPs (the party has seven, including co-leaders Lorna Slater and Patrick Harvie) will get ministerial posts but will have minimal impact on SNP policy, which will likely remain tightly controlled by Sturgeon and her inner sanctum. The SNP will hope that the optics of hooking up with the Greens will boost their environmental credentials in