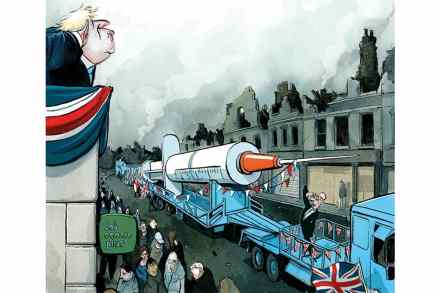

Five lockdown questions the cabinet must ask

The cabinet will meet this afternoon, with more restrictions and even a new lockdown on the agenda. But have ministers been given the information they need to make an informed decision? There are rumours of briefing documents being sent around over the weekend with a pro-lockdown bias (i.e., heavy on the worst-case scenarios and not much said about potential side-effects). But the Times today reports that this time around the cabinet wants a full discussion — with at least ten ministers demanding a better quality of briefing before decisions are made that affect the lives of millions. The below is a list of questions that ministers need answered: 1. What