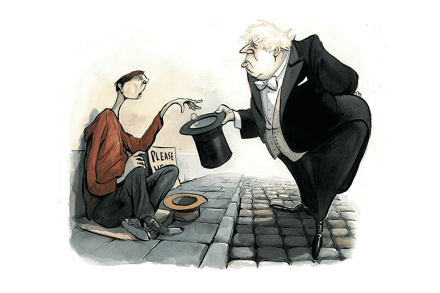

Where is the Boris agenda?

It’s a common trap: a Prime Minister is asked whether he or she will fight the next election as leader. To which there are only two answers: to say ‘yes,’ or announce your resignation. But – here’s the trap – saying ‘yes’ can be easily translated into Thatcher-style declaration that you want to “go on and on” – in Boris Johnson’s case, the papers say he wants to last to the 2030s. Not a timescale he mentioned. But he did talk about a “third term” and is blaming his by-election defeats on voters not thinking enough about the future. ‘If you look at the by-elections, people were absolutely fed up