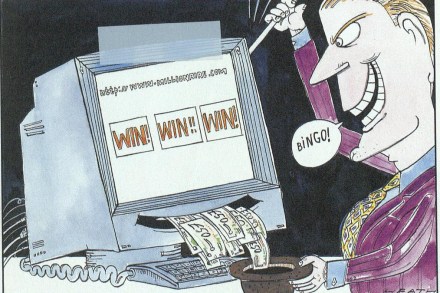

Will the OBR’s £22bn ‘black hole’ review vindicate the Tories?

Are the details of the alleged £22 billion fiscal black hole about to be revealed? In addition to providing assessments and forecasts for the UK economy alongside the Chancellor’s Budget on Wednesday, the Office for Budget Responsibility is also set to publish its ‘review’ into Rachel Reeves’ claim that the Tories covered up a multi-billion pound black hole in the public finances – one that she was only able to unearth after she entered the Treasury. Since Reeves first made the accusation in July, there has been lots of speculation about how the figure was compiled – and exactly where the money went. The Treasury has not released a breakdown