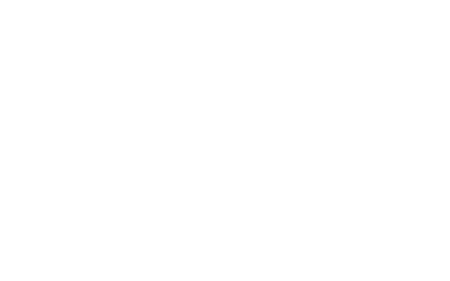

The illustrated guide to the Brown bust

The Brown Bust: house prices This is the first in a short series on the illustrated Brown Bust, we’ll show you graphs looking at the various aspects of the bursting of the Brown Bubble. After failing to control monetary policy – giving the Bank of England an inflation-only remit – the out-of-control money supply led (as it always does) to an asset bubble which has now burst. This graph shows how spectacularly. In little over a year, UK houses have fallen by 14 per cent – more than they did in six years under the Tories. Both lines are rebased to 100, with 100 being the peak of the market