It gives me no pleasure to say I told you so. ‘If [Donald Trump] is prepared to cause mayhem in global trade as his first move, he’s even more dangerous than his detractors thought,’ I wrote in February. ‘British commentators of the “Why can’t we have visionary maverick musclemen like Trump?” persuasion should be careful what they wish for.’ And in November, ahead of the presidential election, I wrote that gold could have ‘more upside ahead’ while bitcoin holders would be wise to take profits – advice that looked wildly wrong in December but finally came right with gold at an all-time high and the cryptocurrency suffering its worst first quarter for a decade.

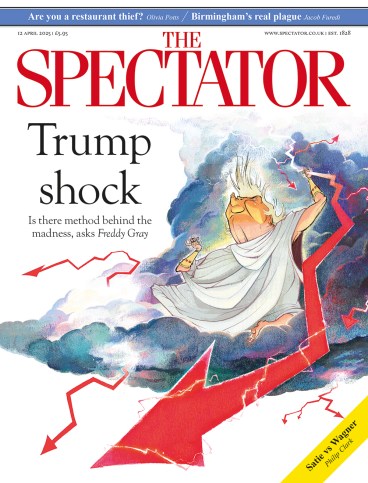

All of which (you’ll think, if you’ve taken refuge in Casablanca for the umpteenth time) ‘don’t amount to a hill of beans’ beside the $10 trillion wiped off global share values since Trump’s so-called Liberation Day. Let’s face it, all market predictions are ephemeral; new ones amid a strengthening tempest would be peculiarly pointless. But what’s perverse about the present imbroglio is that it might actually be better for US stock markets to go on falling, because the ruin of crony fortunes and voters’ pension plans may be the only thing that will persuade the President to reverse his catastrophic course.

Safe-haven gold

‘Sit tight unless you have urgent cash calls’ must be the only advice worth offering any investor today. But I’m grateful to a City reader for this nugget: on the 12 occasions since 1945 when the S&P500 US share index fell by 20 per cent from its peak, it delivered positive returns over the subsequent year in eight of those cases – and in all of them over five years, with an average return of just over 50 per cent.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in