With all these tax cut suggestions kicking about — and with the British economy

desperately in need of some oomph — it’s worth asking: which would help growth the most? It’s not of course the only consideration, but it is clearly an important one as we

struggle to find our way out of recession.

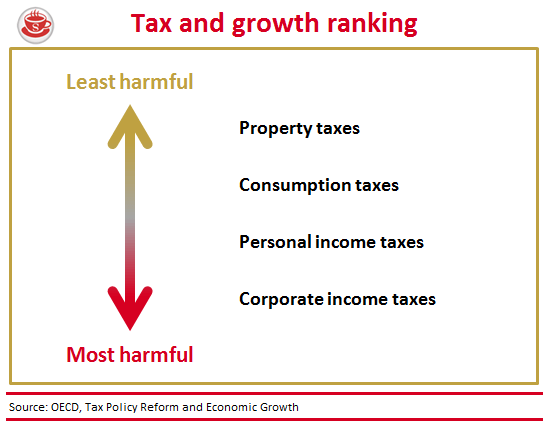

Fortunately, the OECD is on hand with two recent reports to help answer our question. The first, ‘Tax

Reform and Economic Growth’, divides taxes into four broad categories and ranks them on how harmful they are to growth:

This suggests that the Centre for Policy Studies is right — on growth grounds at least — to focus on cutting corporation tax. It also shows the strength of the Liberal Democrat case for

shifting the tax burden from income (by raising the personal allowance) to property (by introducing a mansion tax). In fact, the OECD says that raising property taxes can actually help growth, by

‘shifting investment out of housing into higher-return activities’.

Jonathan Jones

Which tax cuts would be best for the economy?

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in