UK borrowing in 2020-21 hit a record level of almost £300 billion, representing 14.2 per cent of British GDP, reported the Office for National Statistics in June. In the face of the biggest spending challenge since the Second World War, the Treasury, backed by one of the world’s most established central banks, stepped up to supply all the funding needed to pay for furlough, business support and a highly successful vaccination programme.

Now imagine a prime minister in receipt of those borrowing numbers announcing that the future path for the UK is clear: we must disband the Treasury and Debt Management Office; shut down our central bank; start again from scratch with brand new institutions undertaking all those crucial things like issuing government bonds – which will henceforth be denominated in a foreign currency as the new central bank will have no monetary power.

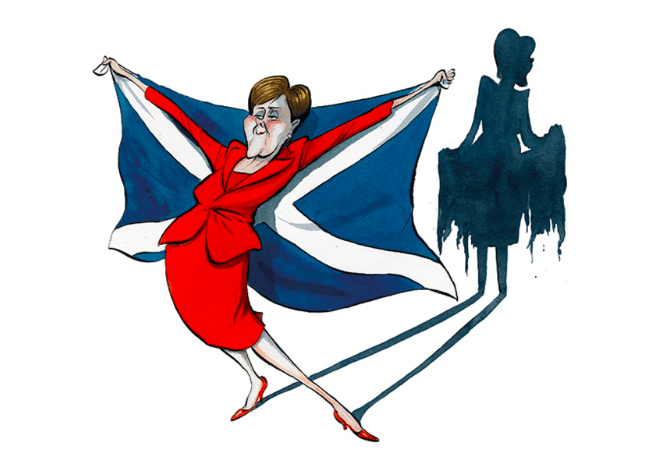

Remarkably, that thought process mirrors the SNP Scottish government’s response to this week’s Government Expenditure and Revenue Scotland (Gers) numbers,

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in