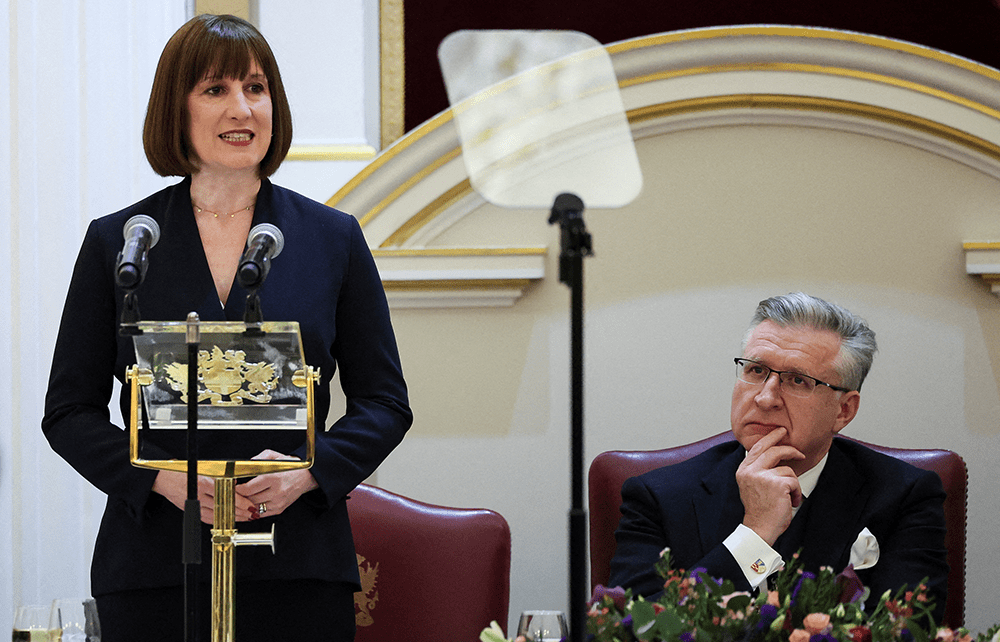

Regular invitations to Mansion House banquets petered out after I asked a shifty-looking waiter for a glass of champagne and he told me he was a deputy governor of the Bank of England. So I can’t report firsthand whether last week’s speech by Chancellor Rachel Reeves was greeted by assembled financiers with napkins on their heads or cries of ‘By George, I think she’s got it!’. What I can say is that – her text having been largely leaked beforehand – she was well upstaged by Governor Andrew Bailey’s unexpected attempt to reopen the Brexit debate; and that she seems to ‘get’ the City a lot better than she understands business owners, start-up entrepreneurs, shivering pensioners, aspirational parents and angry farmers. A low bar, but be thankful for small mercies.

What her banker audience was clearly ready to embrace – not too exuberantly, let’s hope – was a promise to ‘rebalance’ regulation away from ‘a system which sought to eliminate risk-taking’ after 2008 towards a regime with growth and competitiveness at its core, even including relaxation of the ‘pay deferral’ that made them wait longer and work harder for their bonuses.

And the sexier parts of the speech (an even lower bar) showed sensible willingness to build on work begun under her Tory predecessor Jeremy Hunt, whose Mansion House Compact with major pension funds in July last year was the precursor of Reeves’s plan to crunch local government pension schemes into ‘mega-funds’ that would invest, as Australian and Canadian funds do, in high-growth companies and infrastructure. That could be a hugely valuable redirection of capital: but will the Chancellor have the mettle to drive it forward when her non-City policies inevitably start falling apart?

The central problem

Even sexier, possibly, were glimpses in the speech of Pisces and Digit, two more innovations whose origins pre-date the general election.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in