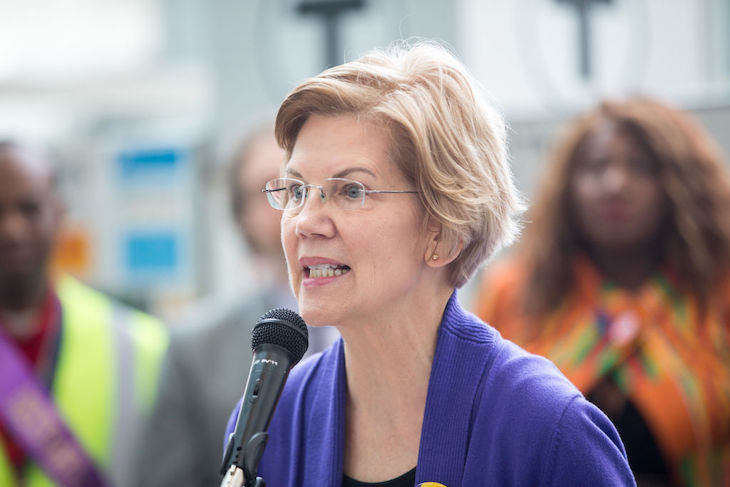

Wealth taxes are back in fashion. In the United States, Senator Elizabeth Warren is proposing an ‘ultra-millionaire tax’. In the UK, there are calls for greater taxation of property from a coalition stretching from Lord Willetts, a former Conservative minister, to Owen Jones and other Corbynista activists. I say ‘back’ in fashion, because these taxes appear to be subject to a cycle of sorts – endlessly proposed, debated, then… quietly set aside.

Most of the recent UK examples have focused on property. The Tories’ ‘dementia tax’ – a phrase coined by Policy Exchange’s Will Heaven in The Spectator – is remembered all too well from the ill-fated 2017 election. Before that there was Ed Miliband’s ‘mansion tax’, proposed in 2013, which was to be targeted at homes over £2m in value. There was Nick Clegg’s one-off ‘emergency’ wealth tax proposed in August 2012, and a ‘tycoon tax’ proposed in March earlier that year with little detail – other than that it would be aimed at millionaires.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in