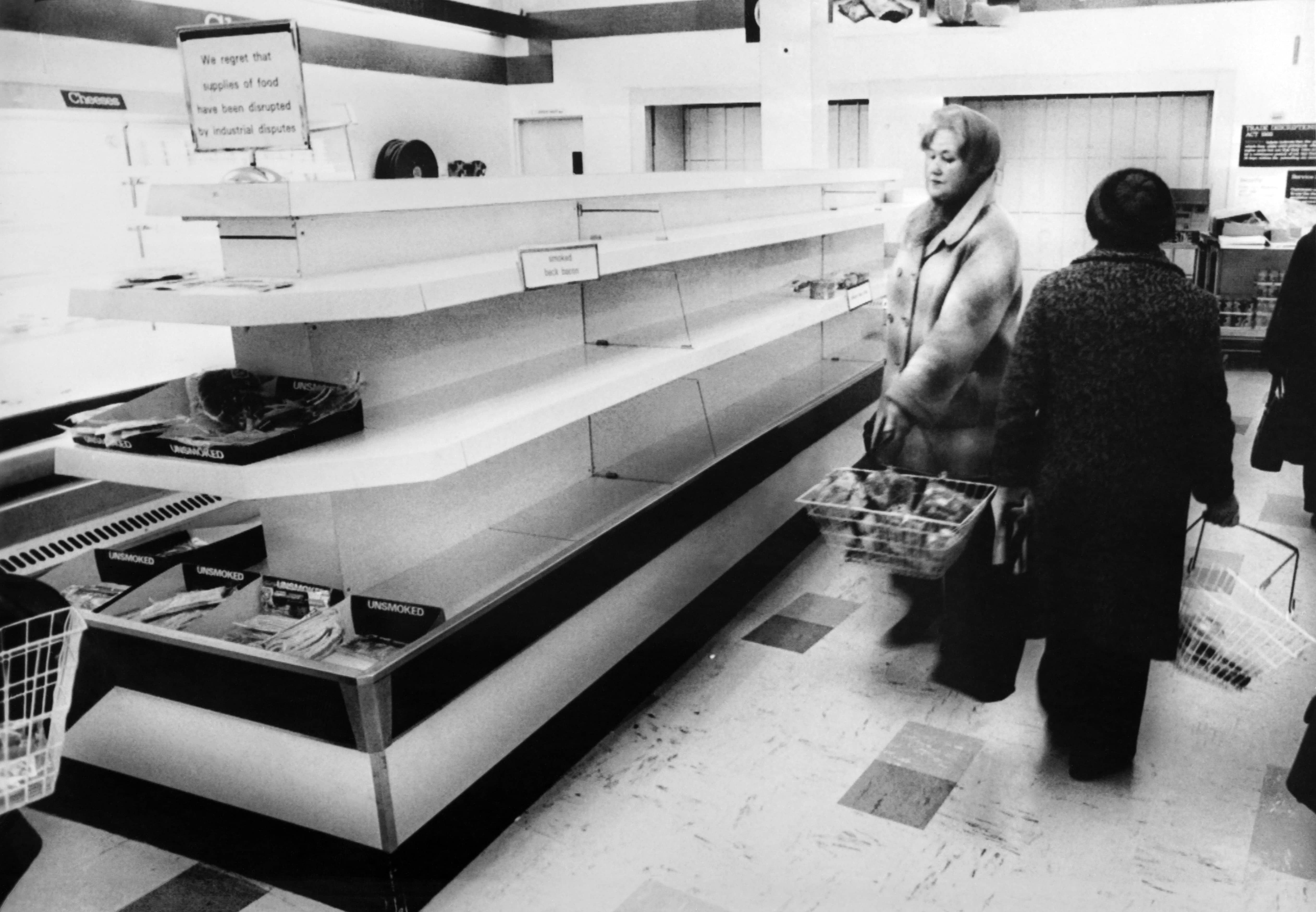

There are eerie parallels with 1970s at the moment, I say in the Times today. The inflation of that decade was principally caused by the abandonment of the gold standard in 1971 and the oil shock of 1973-4, which saw the price of a barrel of oil go from $3 a barrel to $12. Today, we have seen huge amounts of quantitative easing from central banks to keep the economy going through Covid – and unlike the post-financial crash QE, which was largely used to repair banks’ balance sheets, it has gone into the real economy. On top of that, we have now seen the gas price rise fourfold. There are other supply issues too; just look at how the shortage of lorry drivers is affecting petrol deliveries.

Unlike the post-financial crash QE, which was largely used to repair banks’ balance sheets, it has gone into the real economy

High energy prices are a big driver of inflation and energy companies are already pushing Ofgem to lift the household price cap by 20 per cent from April.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in