A ‘black swan event’, as defined by the risk analyst Nassim Nicholas Taleb in 2007, is a surprise occurrence that has a major impact on the global financial system and is rationalised after the fact as something that ought to have been expected all along. The 9/11 terror attacks are one example, the Covid pandemic another – shocks that rocked the world and made us wonder if freedom works.

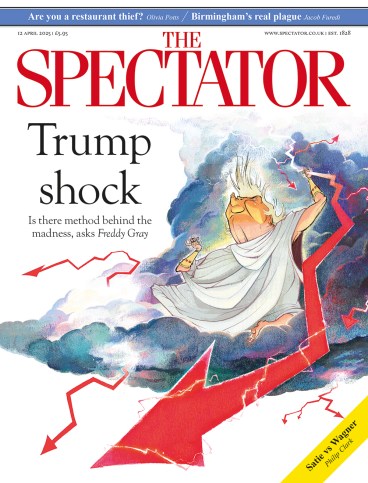

Since Wednesday last week, however, the gods of the marketplace have been wrestling with a new and more mind-boggling creature: the ‘orange swan’, a cataclysmic Donald Trump-induced happening that is at once entirely predictable and baffling, an event that is rationalised post hoc as a shock when in fact everybody saw it coming a long way off.

Everyone knew that the US President, who has for at least 40 years been obsessed with international trade deficits and America being ripped off, was bound to impose dramatic tariffs on the rest of the world. He kept telling anyone who’d listen. ‘It must be hard for you to spend 25 years talking about tariffs as being negative and then have somebody explain to you that you’re wrong,’ Trump told John Micklethwait, editor-in-chief of Bloomberg News, in October. ‘Tariffs,’ he has said repeatedly, ‘are the most beautiful word in the dictionary.’ Long before his election victory last November, in campaign website documents and Trump-agenda videos, he spelled out that protectionism was the central part of his plan to usher in a new golden age for America.

Yet the world had convinced itself that Trump must be bluffing somehow. These were mere ‘negotiating tariffs’ – not a kamikaze mission to blow up the liberal order.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in