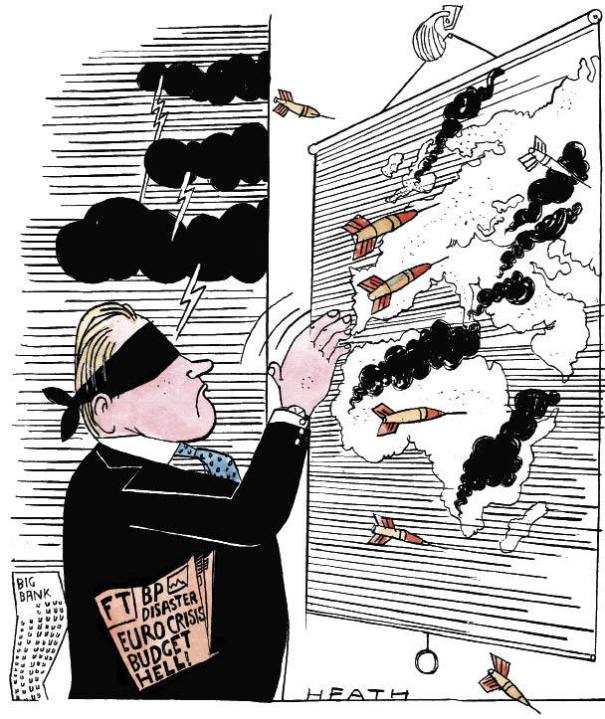

Jonathan Davis thinks this week’s Budget will prove positive for British investors, but that it’s increasingly important to take a global view of markets and currencies

There was nothing in George Osborne’s emergency Budget on Tuesday to contradict the idea that the transition from Labour to Conservative (or in this case Conservative-led) governments tends to be good for the investing classes. The fall of the Callaghan government in 1979 was followed after an initial period of uncertainty by the start of an 18-year bull market that was resilient enough to survive two nasty recessions, the 1987 crash and our undignified exit from the ERM in 1992. There were similar bull markets for shares in the mid-1930s, following the formation of a Conservative-dominated National Government, and in the Eden-Macmillan years in the 1950s.

This time round, the stock market’s response is again likely to be positive, once it has had time to digest unpalatable items such as the rise in capital gains tax for higher-rate income tax payers.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in