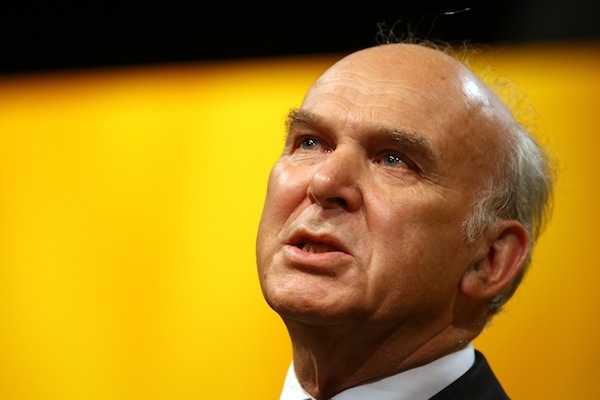

When economists get things wrong– something rather easy, given the nature of their subject – they should admit that they got them wrong. Well, the Adam Smith Institute got it wrong. Two years ago we predicted that, if Vince Cable got his way and capital gains tax rates were increased to match income tax rates – up from 18 per cent to 40 per cent or even 50 per cent – the Treasury would not make anything out of it, and would actually lose £2.48bn in revenue.

In the event, CGT was not raised to 40 per cent or 50 per cent. But it was raised to 28 per cent from 18 per cent for most asset sales. (The entrepreneurs’ rate, designed to encourage people to build up lifelong businesses, remained at 10 per cent.) The result? The Treasury is about £4.9bn worse off than it was before. We were wrong, but only in terms of being far too conservative about the revenue losses that a tax hike would bring.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in