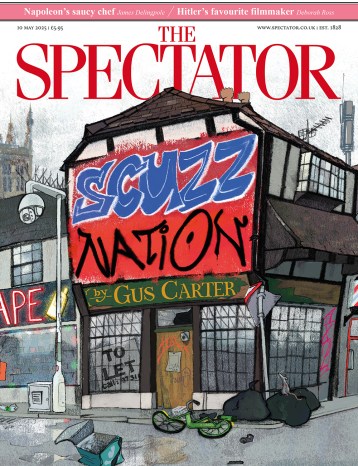

Spring is property auction season, when a motley collection of semi-derelict houses, flats with leases in the single figures and the homes of mortgage defaulters get sold off. This year, though, a scan of the catalogues of some of the UK’s leading property auction houses reveals a new class of property under the hammer: rental flats.

Under pressure from rising interest rates and increasing regulation, many landlords are opting for an exit strategy. According to recent research from estate agent Hamptons, Britain’s rental sector is losing homes at a rate of 66 per day. Agents across the country report an influx of instructions from small-time landlords who’ve decided to invest elsewhere.

The great rental exodus has been triggered by a complex mixture of government policy and wider economic conditions. But one thing is clear. Owning a buy-to-let (BTL), once seen as a copper-bottomed way to earn an easy, passive income, is rapidly becoming a financial albatross.

Britain’s best politics newsletters

You get two free articles each week when you sign up to The Spectator’s emails.

Already a subscriber? Log in

Comments

Join the debate, free for a month

Be part of the conversation with other Spectator readers by getting your first month free.

UNLOCK ACCESS Try a month freeAlready a subscriber? Log in