No

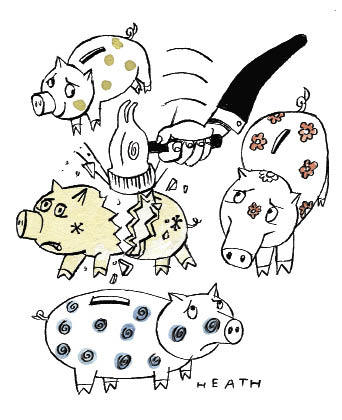

The proposal on the American table is simple: break up the so-called super banks. To have the deposit-taking banks in one place, and the risk-takers (or proprietary traders) in another. The aim is laudable: that Main Street should not have to pay for Wall Street. This is, after all, the system which existed under Glass-Steagall, the Depression-era legislation. But that broke down, because finance became much more international, ingenious, complex and important. That global genie cannot be squeezed back into the national bottle — and if Obama tries, some genies may well bring their tax dollars here.

The banking disease was not obesity but behaviour. Financial institutions got into deep trouble principally because of old-fashioned bad banking and weak risk management, not because of proprietary trading or newfangled derivatives. Lehman Brothers, whose failure precipitated the crisis, was not even a bank. To draw distinctions between the types of banks may well be a radical solution — but it is one which does not address the problem.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in