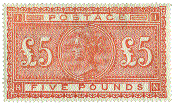

Stamps, it is said, are the most valuable commodity on earth by weight. An 1868 Benjamin Franklin stamp, for example — a standard-sized stamp weighing a fraction of a fraction of a gram — was bought recently for $2.97 million by an American investor. So the claim may well be true.

Rare and desirable stamps, in good condition, can make impressive investments. The GB30 index, which tracks the values of the 30 rarest Great Britain stamps, has ‘never once fallen in the last 50 years’, says Geoff Anandappa, investment portfolio manager at the stamp dealers Stanley Gibbons in London. ‘It has gone up by an average of

10.7 per cent per year over the last 50 years, and by 10 to 15 per cent per year in the last five years.’

Even hardened financial investors are impressed. Bill Gross, director of the fixed-income investment fund Pimco, which has $687 billion under management, says stamps are a better investment than the stock market. He’s the one who bought the Benjamin Franklin stamp, so he must have given some deep thought to the question of relativities with other asset classes. Gross started investing in stamps about ten years ago. Recently he auctioned his portfolio of Great Britain stamps in New York, giving the proceeds to the charity Doctors Without Borders. He originally bought the collection of stamps for $2.5 million; the pre-auction estimate for them was $5 million, and $10.5 million was realised in the actual sale.

Stanley Gibbons is one of the world’s leading stamp dealers, founded in 1856 on the basis of the purchase by Edward Stanley Gibbons of a sackful of rare triangular stamps from the Cape of Good Hope. The company now manages between £10 and £12 million of stamp investment portfolios.

In the world of philately there are two types of buyer: collectors and investors.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in