Home

Jeremy Hunt, the Chancellor of the Exchequer, delivered what he called a ‘Budget for growth’. He abolished the cap on savings for tax-free pensions and promised help with childcare costs. The Office for Budget Responsibility forecast a fall in inflation to 2.9 cent by the end of 2023 and a fall in GDP of 0.2 per cent. Twelve regions for new investment zones were named. Corporation tax would rise to 25 per cent but for small businesses capital expenditure would be tax deductible. Nuclear power and quantum computing would be encouraged; back pain and mental health problems discouraged. The pothole fund would grow. Holyhead Breakwater would benefit. Duty on alcohol went up, but duty on draught products in pubs would be less. Fuel duty remained frozen; subsidy of domestic energy bills would continue to the end of June. Defence spending would be nearly 2.25 per cent by 2025. The nine million cats in Britain must be microchipped by June.

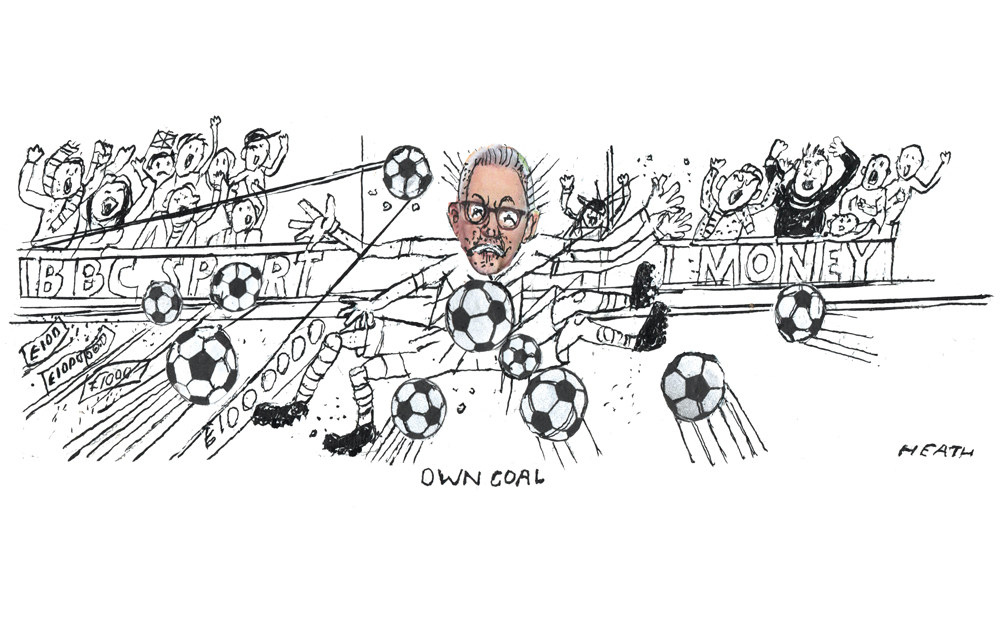

Rishi Sunak, the Prime Minister, agreed to pay France £500 million to help stop migration in small boats across the Channel; in Paris he met President Emmanuel Macron, who rubbed his back in greeting. The government announced an ‘aspiration’ to invest 2.5 per cent of national income in defence, but would not say when. Britain was plunged into a week of ceaseless chatter when Gary Lineker was stopped from presenting an edition of Match of the Day after the BBC found his ‘recent social media activity to be a breach of our guidelines’. In a tweet the presenter had likened the language used by the government to set out its migration policy to ‘that used by Germany in the Thirties’. As other presenters downed tools, Match of the Day went ahead without punditry, and attracted 2.58 million

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in