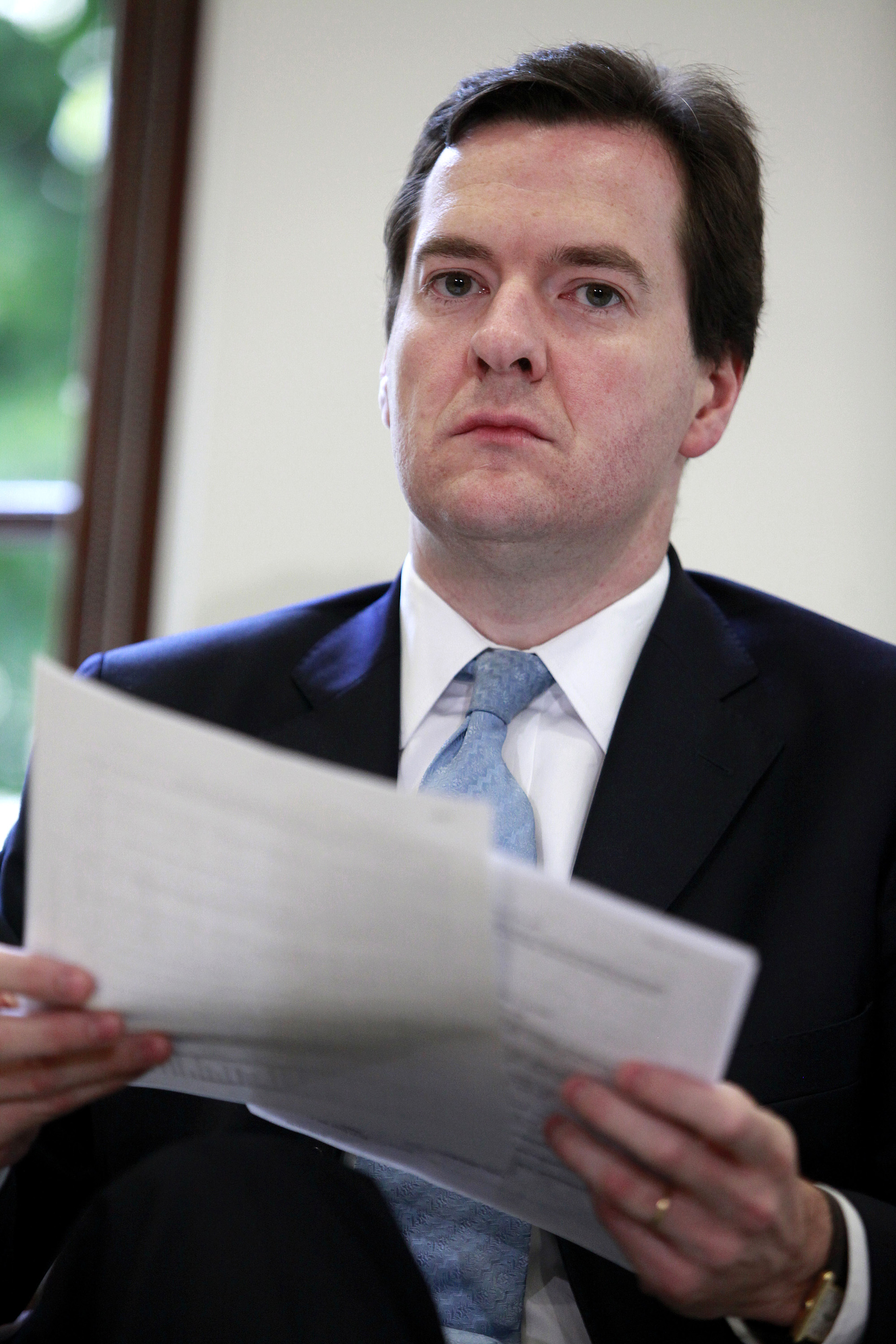

George Osborne had been expected to subject child benefits to tax. Instead he is to

abolish them entirely for higher-rate taxpayers. I’ve spent this morning talking to friends, whose judgment I

respect, who are furious about Cameron hitting the squeezed middle. I cannot agree, and here’s why. We are not talking about the “squeezed middle” here – of the 30.5 million income

tax payers in Britain, just 3 million pay the top rate of tax (figures here). They’re the best-paid 10 percent – and I have

never worked out why the tax of the average worker (who’s on £22k) should be higher to afford the payment to those on twice as much money. Osborne reckons he will save £1 billion by

this measure. If there are to be cuts, this strikes me as a fair cut.

George Osborne had been expected to subject child benefits to tax. Instead he is to

abolish them entirely for higher-rate taxpayers. I’ve spent this morning talking to friends, whose judgment I

respect, who are furious about Cameron hitting the squeezed middle. I cannot agree, and here’s why. We are not talking about the “squeezed middle” here – of the 30.5 million income

tax payers in Britain, just 3 million pay the top rate of tax (figures here). They’re the best-paid 10 percent – and I have

never worked out why the tax of the average worker (who’s on £22k) should be higher to afford the payment to those on twice as much money. Osborne reckons he will save £1 billion by

this measure. If there are to be cuts, this strikes me as a fair cut.

Indeed, why stop there? Winter fuel payments should be next: this is a misnomer, a New Labour scam hurriedly assembled to try and buy votes to recover from pensioners.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in