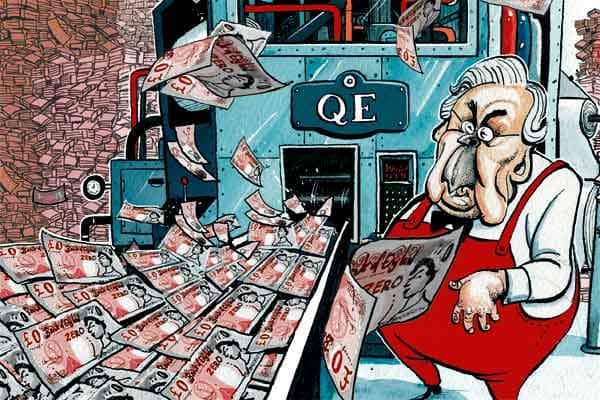

Some £500 billion was printed by the Bank of England during the pandemic – a staggering sum that caused very little public debate. Those sceptical about so-called ‘quantitative easing’ argue that it causes inflation – and with today’s news that inflation rose 9 per cent on the year in April, is anyone linking the two? Step forward Mervyn King, former governor of the Bank of England, who was surprisingly critical when speaking to Andrew Marr on LBC last night.

One of the major problems, Lord King said, was that the Bank went too hard and too fast with its money printing. ‘Governments stepped in and put in a lot of money for furlough schemes or raising unemployment benefits. That was very sensible,’ he said. ‘The problem was that central banks also printed a great deal of money and that wasn’t needed… it put a lot of money into the system.’

Under classical economic theory, when a lot of money is put into the system (as it has been in the UK and in the US with the Federal Reserve printing about $4.8

Britain’s best politics newsletters

You get two free articles each week when you sign up to The Spectator’s emails.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in