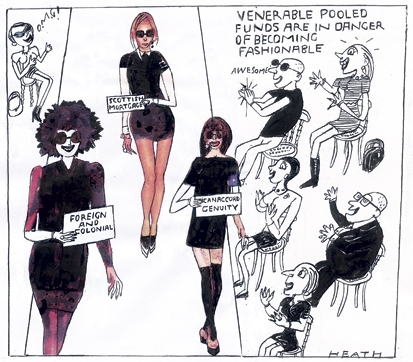

After years in the doldrums, investment trusts — those venerable pooled funds with names like Foreign and Colonial and City of London — are in danger of becoming fashionable. There are good reasons why they should be better known. They offer the possibility of high returns at low cost, as well as access to exotic asset classes that would otherwise be out of reach. They can be a way of spreading risk, if you do not have the time or the inclination to pick individual stocks for yourself. And they are generally cheaper than other vehicles for collective investment, such as unit trusts; the idea is that as little of your money as possible is eaten up by the layers of charges which Warren Buffett’s lifelong investing partner Charlie Munger vividly described as ‘the croupier’s take’. They are also surprisingly fascinating, or so I’ve found as a self-taught enthusiast.

For decades, City folk have favoured investment trusts over unit trusts and open-ended funds. Independent financial advisers ignored them, however, since they did not pay any commission. That, and the fact that unit trusts are easier to explain, has meant that the open-ended sector has dominated. Now, thanks to the Retail Distribution Review, the playing field has been levelled. From April, funds will not be allowed to pay commission to IFAs. So it is no longer in advisers’ and brokers’ interests to ignore investment trusts. Already retail investors are cottoning on to the advantages, and last year saw a 66 per cent rise in purchases of investment trusts through fund supermarkets.

Because investment trusts don’t pour money into marketing, they have been able to keep their charges under control. (The menace of performance fees is creeping in, but that is a discussion for another time.) Many, after all, were set up for canny Scotsmen. Take Scottish Mortgage, which I hold shares in.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in