Scrapping the cuts to tax credits. Ring-fencing health care, and spending a few billion on a high-speed rail link from London to Birmingham. Despite all the howls of outrage from the left about austerity, for a country that was meant to be broke, we have a government that still throws around a lot of cash. Where’s it all coming from? If you have been saving for a pension, the answer is: probably from you.

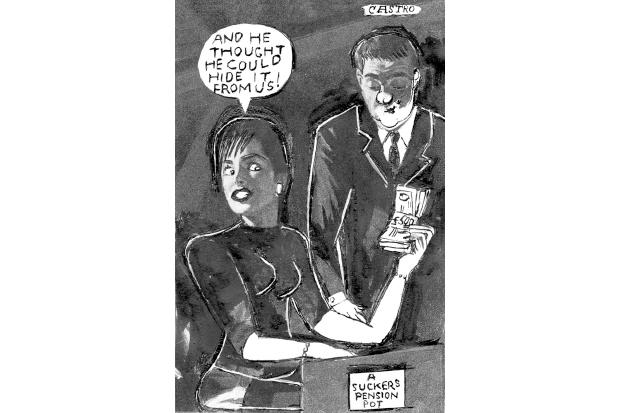

Over the past few years, George Osborne has become almost as skilful as Gordon Brown was at raising taxes without anyone noticing too much. Since his early and brutal rise in VAT, a tax that hits everyone every time they shop, he has put his revenue-raising measures into the small print. The self-employed have been stung with new ways of taxing their personal service companies. Buy-to-let landlords have been hammered with changes on the way the money that they borrowed to buy their properties is treated. It has compounded the pain of sky-high property prices with stamp duty of up to 12 per cent. And perhaps most of all, the Chancellor has dipped into the pension plans of the salaried middle classes. Since 2010, he has raised an estimated £5 billion a year — slightly more than the cost of the prison service — by chipping away at higher-rate tax relief on pensions. Lifetime limits on the amount you can put in while still getting tax relief have been introduced. There are rumours that this spring he may go all-in and impose a flat rate of pension relief (at the moment 40 per cent taxpayers get 40 per cent relief on their pension contributions, 20 per cent taxpayers get 20 per cent, and so on).

That would raise a huge amount of money. Tax relief on pensions ‘costs’ the government £34 billion a year, according to HMRC calculations. Most of that ‘cost’ flows to the better off, for the simple reason that tax relief is worth a lot more if you are paying 40 per cent tax than 20 per cent. If the Chancellor doesn’t claw some of that cash back, it is hard to see how he is ever going to close a budget deficit that remains obstinately high even towards the top of the economic cycle.

You can argue for ever about whether that is right or wrong. But it’s clear the government is steadily making saving for a pension less attractive for the better-off. From this April, the lifetime limit will be reduced to £1 million. Once your pension pot exceeds that amount, you won’t get any more tax relief. While £1 million sounds a lot, Legal & General calculates that it would buy a 65-year-old a retirement income of just £29,000. If that limit is tightened even further, and higher-rate relief is also scrapped, then conventional pension schemes are going to play an ever more minor role for people on a decent income. The trouble is, where else can you go?

Property is one answer. One explanation for the huge rise in buy-to-let investment has been that a lot of people have been buying one or two flats to supplement their income in old age. There are now 3.8 million private-rental properties, compared with 2 million in 1999, and a lot belong to people looking to top up their pensions. But landlords are even higher on Osborne’s hit list than pensioners. They now pay a higher rate of stamp-duty than that on first properties, and the cost of a mortgage can no longer be deducted from the rent. That said, property remains an unbeatable way of saving. It is a myth that rents have risen much — they have just kept pace with average earnings — but the returns are constant. As earnings rise in real terms, as is normal in any moderately successful economy, yields on a rental property will go up as well.

Even better, you can always just buy a bigger house for yourself. The one huge tax break that remains sacrosanct — even the Green manifesto rather sweetly promised to maintain it, despite clobbering just about every other form of economic activity — is the exemption from capital gains tax on your main home. Buy the most valuable one you can afford, and downsize when you hit 70, and you should have a pile of tax-free cash.

Alternatively, stocks-and-shares ISAs are becoming more attractive. While those based on cash will be semi-redundant when tax allowances on savings go up in April, the Chancellor has hugely increased the amount you can put into the stocks-and-shares variety, as well as the range of investments. That of course comes out of taxed income. But once it is there, it is tax-free. With a pension, you get the tax break on the way in; with an Isa on the way out. Put £15,000 a year into an Isa and over three working decades you should build up a million or more, which would pay out a healthy income free of further taxes.

Admittedly, if enough people save for a pension through Isas, some future chancellor may start attacking those tax breaks as well. But that is a long way off. One consequence of the Chancellor’s squeeze on pension tax breaks will be that people more and more look for other places to put their money, and shift their assets into whatever does still come with some tax breaks. You can change the rules — but it is very hard to change the fact that people will always pay as little tax as they can get away with.

Comments