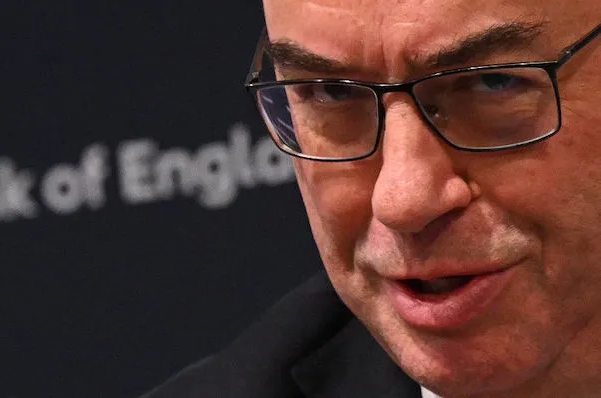

Interest rate cuts are beginning to look like a mirage: the closer we seem to get to them the more they seem to recede into the distance. Bank of England governor Andrew Bailey may have hinted this week that UK rates could soon be cut regardless of what happens in the United States, where strong jobs data is putting off the Federal Reserve from cutting rates, but this morning’s inflation data will not encourage an early cut.

While the Consumer Prices Index (CPI) did fall in March, from 3.4 per cent to 3.2 per cent, this was less than the fall which was expected. The rise in road fuel prices largely cancelled out a drop in food prices.

CPI should go down much more substantially next month, as April’s fall in the energy price cap comes into the figures, but looking further ahead the outlook is far from benign. Iran’s attack on Israel over the weekend, and possible Israeli response, has reignited the situation in the Middle East, coming on top of cuts in oil production by Opec countries.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in