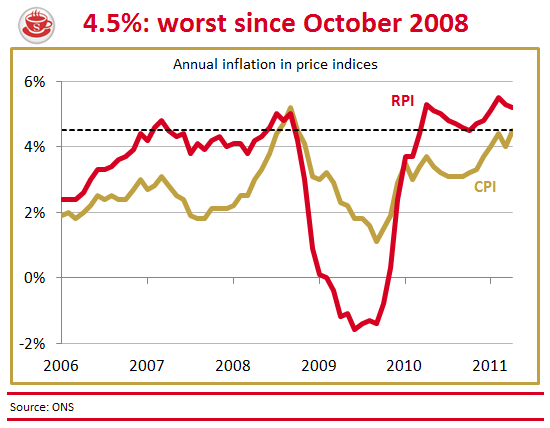

Good job we didn’t unravel the bunting after last month’s inflation figures. Because today we discover that CPI inflation rose again in April, by 0.5 percentage points, to 4.5 per cent — its highest level since October 2008. That drop in March does look like a blip after all. Even with RPI inflation continuing to fall (by 0.1 percentage points), we seem to have returned to a grim, upwards trajectory. Most forecasters predict that inflation will keep on rising for the rest of this year, outstripping wage growth along the way. The squeeze on living standards continues:

We have dwelt on the political problems this creates for Osborne before, so suffice to say that they will not be eased by one-month, one-off falls in the rate of inflation. It is the overall trend that matters, and the overall trend is unforgiving at the moment. The Bank and the Treasury appear determined that interest rates be kept at emergency lows to stimulate growth — an understandable enough position.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in