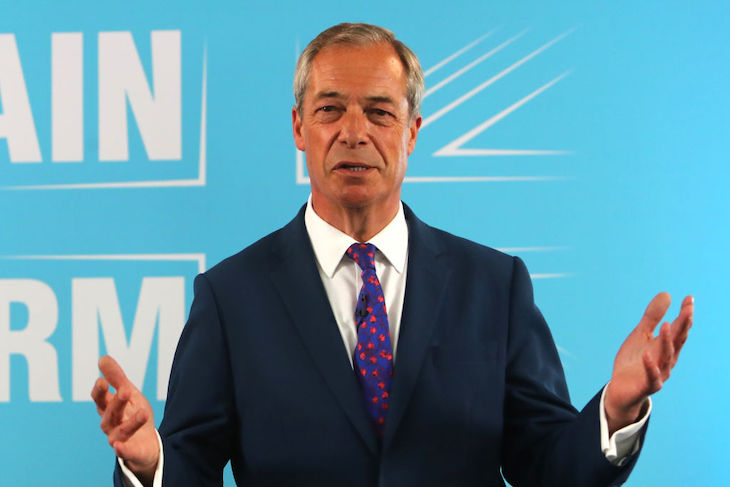

Why did it take Nigel Farage to suggest clawing back some of the super profits pocketed recently by British banks? Why hasn’t Labour thought of stopping the Bank of England paying interest on the deposits of commercial banks?

There is, after all, plenty of money for the taking. In 2023, HSBC reported a record net profit of over $30 billion (£24 billion). Lloyds made around £5.5 billion and Barclays trousered £6 billion. The UK banks have never had it so good.

They have been coining it because of high interest rates which acts like a reverse ATM machine. The Reform election manifesto, sorry ‘contract’, proposes accessing some of this by getting the Bank of England to stop paying interest on the £700 billion in deposits of commercial banks held under quantitative easing. This is not some naive Marxist idea cooked up by Jeremy Corbyn and John McDonnell. It is a reform that has been discussed for years in financial and academic circles. Indeed, there is something approaching a left-right consensus that it is time to halt this particular public subsidy to the financial sector.

This is precisely the kind of stealth tax – as lucrative to the exchequer as it is hard to explain to voters – that Gordon Brown would have brought in

Ending central bank interest could bring in around £35-£40 billion, according to many economists. The Institute for Fiscal Studies say the measure would likely yield only half of that. But that would still be more than the £18 billion black hole they have identified in the financial prospectuses of the major parties in this election. At any rate, it seems worth a shot.

We have a windfall profits tax on the oil and gas industry, so why not on the banks? Labour seems to think it can build the new Jerusalem by taxing non-domiciled businessmen on their non-UK earnings. But these guys are already making plans to move their activities to more favourable tax regimes. The clue is in the name: ‘non-domiciled’. Footloose plutocrats can go where they please. Even if they remain, taxes on their UK earnings will bring in less than £3billion.

Why resort to piddling taxes like abolishing VAT on private schools, which is going to bring in pennies, when you could be creaming off some of the recent gains of the very financial institutions that helped cause the 2008 financial crash and who had to be bailed out by tens of billions from UK taxpayers?

This is precisely the kind of stealth tax – as lucrative to the exchequer as it is hard to explain to voters – that Gordon Brown would have brought in when he was chancellor in the late nineties. The stealth tax he did introduce back then, abolishing dividend tax relief on pension funds, brought in money alright, but it suppressed the living standards of a generation of pensioners. This stealth tax would hit the pariahs of the capitalist economy.

This measure from Farage is not the politics of envy, still less is it taxing enterprise. Indeed, halting central bank interest isn’t really a tax. It would simply stop banks earning interest for doing nothing.

Quantitative easing was introduced after the financial crash, you may recall, to salvage the banks from their own reckless avarice. It was also supposed to stimulate investment and economic growth, as well as prevent another systemic collapse of the financial system. It failed in the former and the jury is still out on whether the UK banking system has learned its lesson and is now crash-proof. Those 100 per cent mortgages that the banks are handing out again do not inspire confidence.

The 2008 banking crash was caused by irresponsible lending on sub prime mortgages by commission-hungry commercial banks. It was based on the expectation that, if it all went pear shaped, the government would step in to rescue them because they were ‘too big to fail’. Are they also too big to tax? Apparently. The Tories have even lifted the cap on banker bonuses just at the very moment that banking profits have gone through the roof.

The commercial banks never used to earn interest on central bank deposits before 2006. It has only really become the norm since the crash. The.bankers and their lobbyists will, of course, claim that this move would cause liquidity problems and make the system less stable. Equally, it might just make them work a little harder.

I think Nigel Farage is onto something here. The banks have had a very good deal from the taxpayer for many years. It’s time for them to put a something back in. We’re all in this together.

Watch more on Spectator TV:

Comments