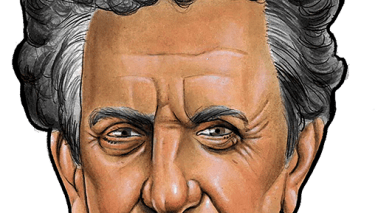

Every time George Osborne takes hold of a red box he seems to come up with another tax-free savings vehicle.

Or so it appears to Individual Savings Account (ISA) savers, who two years ago had two straightforward choices: cash or stocks and shares. Cash for the risk averse, stocks and shares for the risk aware.

Now, depending on your home ownership status and attitude to risk, there are two more options in the mix – the Help to Buy ISA and the Innovative Finance ISA, and one on the way – the Lifetime ISA.

Which to choose? How much to save in each? Navigating the new savings maze requires more motivation than a bush tucker trial – only the most tenacious will pass.

The rest of us are more likely to opt for the ‘get me out of here’ option, and scarper to the nearest high street instant access account which, as it happens, is no longer the shamefully unsavvy option it once was.

As if five ISA options were not enough, the Chancellor has simultaneously rendered ISAs almost redundant to the majority of savers by introducing a personal allowance on all savings of £1,000 of annual interest from April this year.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in