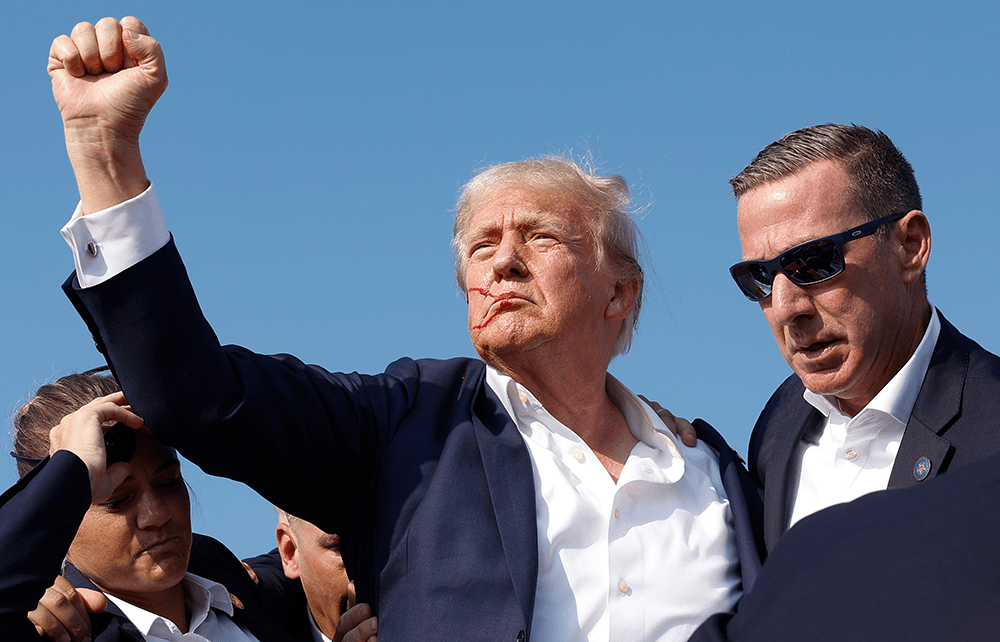

Market reactions to the assassination attempt in Pennsylvania represent, according to taste, rational bets on the significantly increased likelihood of a second Trump presidency or stark confirmation of the madness that has overtaken America and threatens the civilised world.

Shares in Trump Media & Technology – the parent of his social media platform Truth Social – rose by 30 per cent on Monday, adding more than $1 billion to Trump’s notional fortune despite the company’s revenues being, as one observer pointed out, ‘comparable to that of two Starbucks stores’. Also up were shares in gunmakers such as Smith & Wesson and in private prison operators – and US Treasury bond yields, reflecting fears that Trump will let government debt rip. Down, unsurprisingly, were clean energy stocks.

Then there’s bitcoin, up almost 10 per cent in the past few days on top of a six-month rally that has coincided with Trump’s declared enthusiasm for all things crypto: he’s due to address a bitcoin conference in Nashville next week. And frankly, with the way things are going over there, it’s not hard to see why the virtual safe havens of crypto-world, disconnected from the horrors of reality, must look ever more appealing for Americans whatever their political stripe.

Reactions to the shooting were more phlegmatic in London, the FTSE 100 index opening a fraction down – but with one notable 15 per cent faller. That was the luxury brand Burberry, after a bad quarter, a profit warning and a sudden change of chief executive: how ironic, in a season of endless storms, that the biggest loser should be our most famous raincoat maker.

Fading Aim

But let me get back to business as usual – and highlight yet another fissure in London’s underperforming capital markets. A story of the week that hardly anyone noticed was the decision by Destiny Pharma, a Brighton-based biotech, to de-list from the Aim market for smaller companies and seek private equity support.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in