Forget the desirability (or lack thereof) of tax hikes: can Britain survive them? That’s the economic question that kicked off the new year in cabinet this week when Jacob Rees-Mogg was reported to have encouraged the Prime Minister and his colleagues to roll back plans to bring in the new National Insurance levy this April.

A recap on the proposals: the 1.25 per cent National Insurance hike will be paid by both employers and employees, and will eventually be funnelled into social care, we’re told. But for the first few years, most of the tax revenue it raises (roughly £12 billion) will go to addressing the NHS backlog and the millions of people on waiting lists. The Prime Minister argues this cash injection will eventually fix social care, justifying his decision to break a manifesto promise; but ministers such as Rees-Mogg can’t help but notice the cost of living crisis that is already under way in Britain — even before the new levy takes the tax burden to a 71-year high.

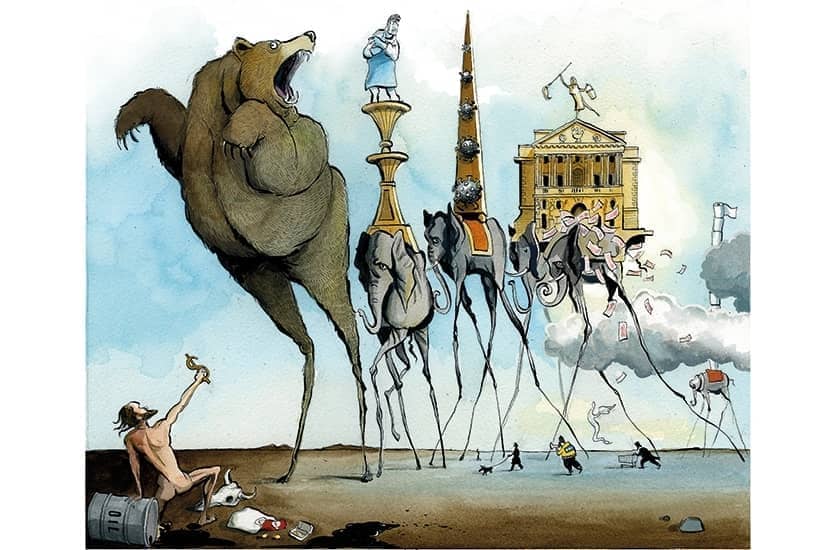

There may be some shortages in supermarkets right now, but no shortage of financial burdens facing a pandemic-weary nation

There may be some shortages in supermarkets right now, but no shortage of financial burdens facing a pandemic-weary nation: energy bills are set to soar this spring, possibly doubling for some people who have been enjoying a fixed rate.

Britain’s best politics newsletters

You get two free articles each week when you sign up to The Spectator’s emails.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in