Starbucks had a go at David Cameron on Sunday for his ‘cheap shots’ at the coffee chain’s tax arrangements in the UK. The company felt it was being unfairly singled out in comments about companies legally avoiding tax needing to ‘wake up and smell the coffee’. So what about other firms known to be avoiding tax?

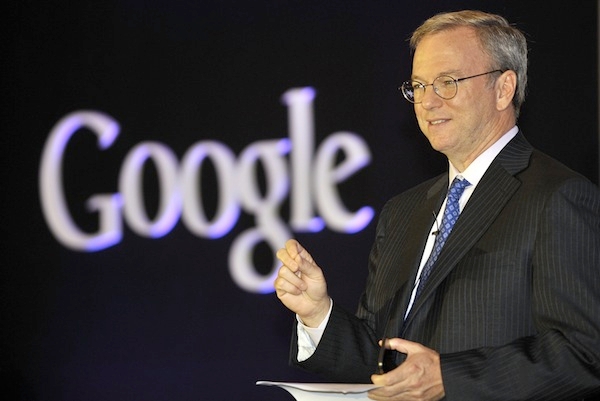

Coffee House has learned that the former Lib Dem Treasury spokesman Lord Oakeshott is writing a rather scathing pair of letters to David Cameron and George Osborne about the government’s dealings with Google, which paid only £6 million in corporation tax in the UK in 2012 by funnelling £6 billion worth of transactions through the tax haven of Bermuda. Google’s executive chairman, Eric Schmidt, currently sits on the government’s Business Advisory Group.

Oakeshott’s letter says that while he strongly supports Osborne’s condemnation in last year’s Budget of aggressive tax avoidance as ‘morally repugnant’, the government is undermining its own campaign by retaining Schmidt on the advisory panel.

Britain’s best politics newsletters

You get two free articles each week when you sign up to The Spectator’s emails.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in