As the year winds down, we approach the season when some investors do an annual portfolio review. Checking in on your investments, whether annually or at some other interval of your choosing, can be quite helpful, in our view. However, we suspect doing so can lead to the temptation to rearrange investments based on the past year’s performance, which may not be a wise long-term move. We think investors are best served to approach an evaluation by assessing whether their overall strategy is in line with their long-term goals, cash flow needs, risk tolerance and time horizon (or the length of time your assets must be invested to keep working toward your goals) — not by dwelling on which categories of shares did best and worst.

We suspect the temptation to shuffle assets based on past performance may be particularly great after 2018, which featured a rather large gap between European and global equity returns. Through November’s end, the MSCI EMU Index (European Monetary Union) was down –7.3 per cent year to date.[i] Yet the MSCI World Index was up 4.8 per cent, in large part because US shares were positive.[ii] This could lead investors to conclude that European shares aren’t a wise investment and sell their eurozone holdings in favour of US shares. Similarly, investors may choose to leave low-returning sectors such as materials and concentrate in information technology or healthcare, which rose 12.3 per cent and 18.2 per cent, respectively, year to date through November.[iii]

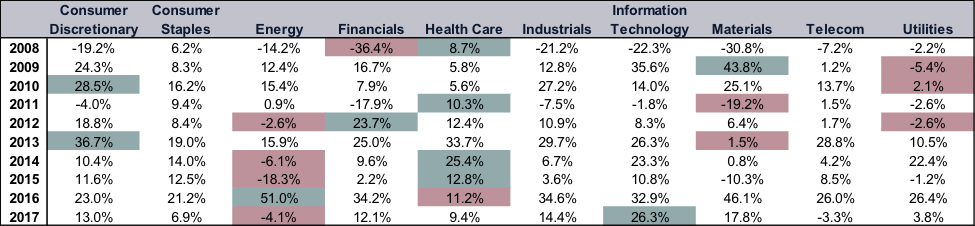

In our view, this mindset can lead investors astray. Past performance doesn’t dictate future returns. Equity market history shows sector and country leadership shifts often. The categories that did best one year may not do well the next. The categories that did the worst one year could improve the next. While European shares are trailing American shares year to date, the opposite was true last year. As Exhibits 1 and 2 show, MSCI World Index sector and regional returns over the past ten calendar years have inconsistent leadership.

Exhibit 1: MSCI World Index Sector Returns

Source: FactSet, as of 28/11/2018. MSCI World Index sector returns with net dividends, yearly, 31/12/2007 – 31/12/2017. The Real Estate and Communication Services sectors are excluded as they have not existed all 10 years. The best-performing sector each year is shaded green, whilst the worst-performing is shaded red.

Exhibit 2: MSCI World Index Regional Returns

Rather than seeing year-end as a time to realign sector and country positioning based on past returns, we think investors are better served by asking a simpler and more forward-looking question: does my portfolio still match my needs? Or, does its mix of equities, fixed interest, cash and other securities (also known as asset allocation) align with your long-term goals, ongoing cash flow needs, tolerance for risk and short-term volatility, and time horizon? If any of these factors have changed over the past year, it may be wise to discuss with your investment adviser and consider whether portfolio changes are necessary to match. After you have nailed down the right asset allocation for your needs, then we think it can be worthwhile to check your sector and country positioning — not to chase past returns, but to ensure you don’t have any heavy concentrations. Target diversification, not the hottest areas. You can’t buy past performance.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: 2nd Floor, 6-10 Whitfield Street, London, W1T 2RE, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

Follow the latest market news and updates from Fisher Investments UK:

[i] Source: FactSet, as of 31/11/2018. MSCI EMU Index return with net dividends, 31/12/2017 – 30/11/2018.

[ii] Source: FactSet, as of 30/11/2018. MSCI World and MSCI USA Index returns with net dividends, 31/12/2017 – 30/11/2018.

[iii] Source: FactSet, as of 30/11/2018. MSCI World Index Information Technology and Health Care sector returns with net dividends, 31/12/2017 – 30/11/2018.

For more information, visit fisherinvestments.com/en-gb.

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in