Terrorism is a real, ever-present risk in the modern world. The recent twentieth anniversary of the 9/11 terrorist attacks reminds us of the tragic human toll and devastating impact to lives, livelihoods and property.

While the prospect of a terrorist attack can be emotional and frightening, Fisher Investments UK believes the historical relationship between terrorism and equity markets offers valuable lessons for long-term investors. In particular, the past 20 years have shown that acts of terrorism alone don’t seem to cause lasting market declines. In our view, this is due to equity markets’ ability to focus uniquely on the economic implications of attacks, measure the economic disruption and efficiently price the world’s economic future.

Terrorist Attacks Often Lack the Power to Derail Equity Markets

Investors have largely accepted the unfortunate reality that terrorist attacks have become a regular part of our lives, but rarely cause fundamental changes to the economic and political factors that drive equities. While attacks can affect investor sentiment in the short term, their ability to surprise markets has waned, given the increasing frequency. As a result, terrorist attacks lack the surprise power and, generally, the scale required to disrupt global markets meaningfully in the long term.

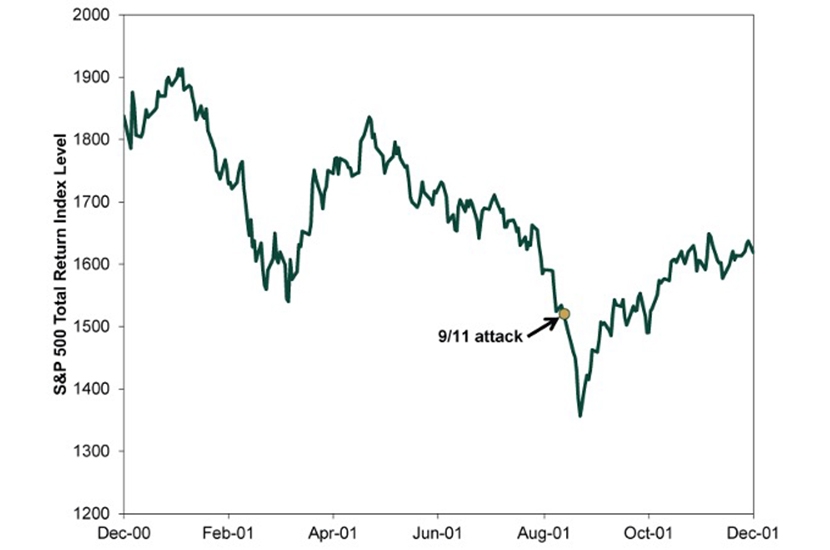

The 9/11 attacks help demonstrate this and explain why. As Exhibit 1 shows, the S&P 500 plunged 11.6% between the market close on 10 September and the post-attack low on 21 September. Attacks of that scale on the World Trade Centre and the Pentagon were unprecedented and unexpected, a shocking tragedy that profoundly wounded the United States. Markets initially reeled in the subsequent uncertainty.

But, then the rout stopped.

Exhibit 1: US Equities and 9/11

Just 17 trading days after the horrific events of 9/11, markets regained their levels from 10 September. In retrospect, it’s easy to understand why this was the case. Society pulled together and got on with daily life. People in lower Manhattan began going back to work. Business resumed, and it soon became clear that, utterly unlike the impact on thousands of families and the national psyche, the economic effects of the 9/11 attacks weren’t huge relative to size of the US and global economy. Markets unemotionally accepted the reality that terrorism was part of our lives—and moved on.

The S&P 500 finished 2001 higher than its pre-attack level. The bear market that started in March 2000 lasted until October 2002 as investors dealt with the dot-com bubble’s collapse and fallout from the Sarbanes-Oxley Act. However, the negativity associated with the 9/11 attacks was short-lived.

Attacks spread, but market impacts shrink

The US has been spared from further major international terrorist incidents; however, attacks in Madrid, London, France and Germany reiterated the constant threat. As terror attacks big and small continued, their market impact shrank and became increasingly difficult to isolate from other variables.

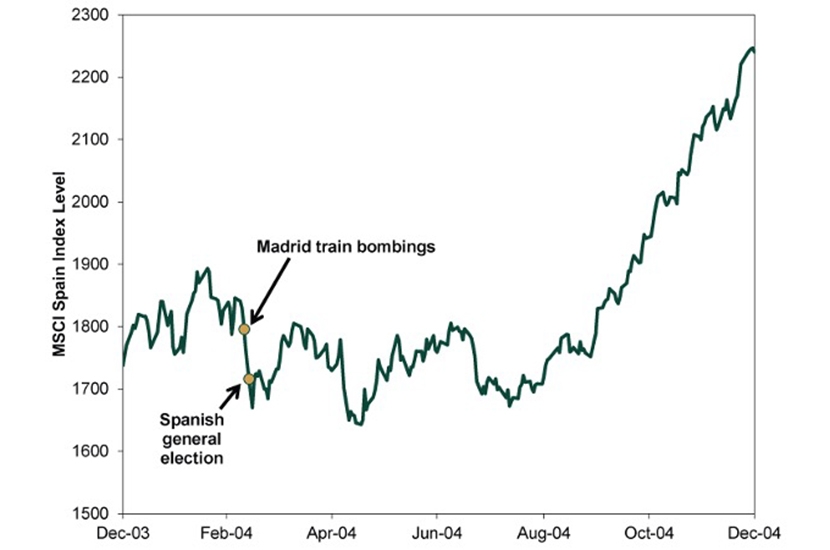

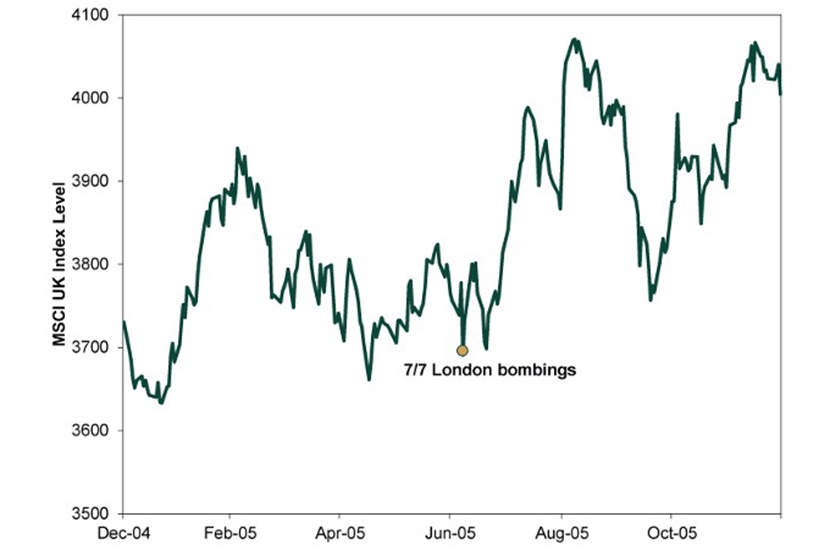

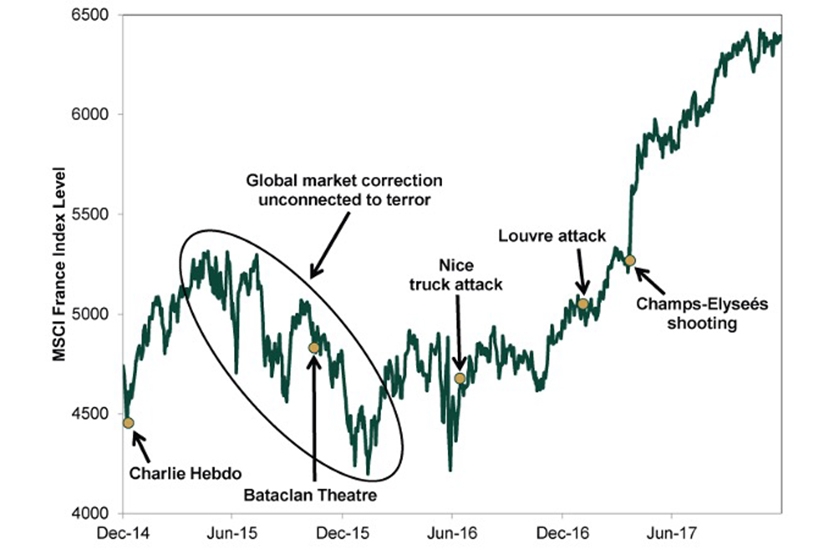

Spanish equities fell 9.3% the week of the Madrid train bombings in 2004 (Exhibit 2), but this incident happened on the home stretch of a contentious general election campaign—often a time of heightened uncertainty for stocks. The following year, UK equities’ apparent reactions to the 7/7 London bombings (Exhibit 4) lasted only a single day. A decade later, a storm of attacks in France (Exhibit 5) arrived during a global equity market correction that stemmed from investors’ overreaction to currency reforms in China, not terror.

Exhibit 2: Spanish Equities and the Madrid Train Bombings

Exhibit 3: UK Equities and the 7/7 Bombings

Exhibit 4: French Equities and the Mid-2010 Attacks

The world isn’t and hasn’t ever been a perfectly safe place. As a long-term investor, you can’t wait for the absence of all fear and strife to invest. Life can be scary and dangerous, but Fisher Investments UK believes stocks are resilient—just like people. Like the people whose transactions they represent, markets are defiant. They stand because we stand, even despite threats and very real tragedies. So trust that free people will continue meeting and overcoming the challenges presented by those who wish them harm.

Get exclusive stock market knowledge in your Markets Commentary guide as the first of our ongoing insights.

Investing in equity markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments Canada and should not be regarded as personalised investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments Canada will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

Follow the latest market news and updates from Fisher Investments UK:

Facebook: https://facebook.com/FisherInvestmentsUK/

Twitter: https://twitter.com/FisherInvestUK

LinkedIn: https://www.linkedin.com/company/fisher-investments-uk

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in